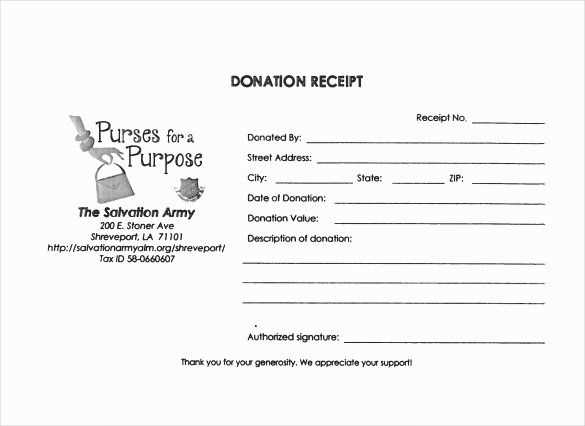

To streamline the process of acknowledging donations, using a pre-designed template can save time and ensure consistency in your communications. A donation receipt letter template in Word format allows for quick customization, making it easy to send accurate and professional receipts. This type of document is essential for both the donor’s tax records and for maintaining transparency in nonprofit activities.

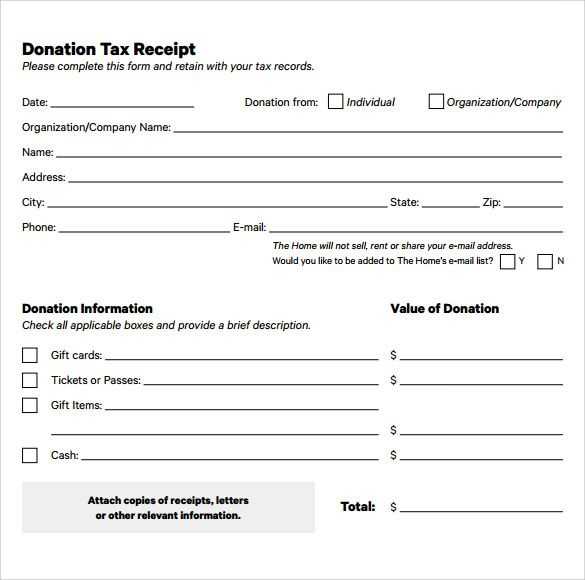

The template should include key details such as the donor’s name, donation amount, date, and a clear statement confirming the nature of the donation (whether it is a cash or non-cash contribution). If applicable, a description of donated goods should also be listed. A good template will also leave space for the nonprofit’s contact information and tax-exempt status, ensuring that all necessary legal and tax-related requirements are met.

Incorporating a Word document format allows easy editing and formatting, so you can make updates or personalize receipts quickly. A clear, professional design will reflect the value of your organization and help build a positive relationship with donors. After customizing the template, you can easily save, print, or email the receipts to your supporters.

Here’s the corrected version of the text:

When preparing a donation receipt letter, focus on clear and concise details. Start by including the donor’s name, donation amount, and the date. Ensure that the nonprofit’s name and contact information are prominent, as well as any tax-exempt status information if applicable.

Structure and Content

The letter should clearly state the type of donation (monetary or in-kind), and whether it’s a one-time or recurring donation. Include a brief thank-you message that acknowledges the donor’s generosity and highlights the impact of their contribution.

Legal Considerations

For tax purposes, mention if any goods or services were provided in exchange for the donation. If there were none, note that the donation is fully deductible. Make sure to sign the letter to add a personal touch, and keep a copy for your records.

Donation Receipt Letter Template Word Document

How to Create a Basic Receipt in Word

Key Information to Include in the Receipt

Formatting Tips for a Professional Donation Letter

Customizing the Receipt Template for Different Donors

How to Add Legal and Tax Details to a Receipt

Best Practices for Sending Receipts to Donors

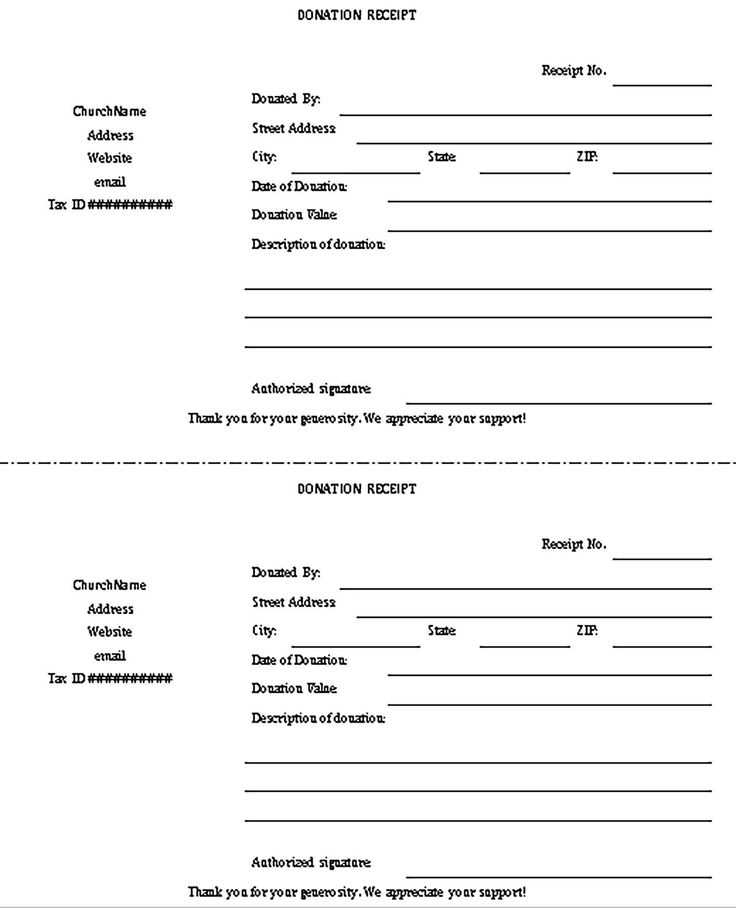

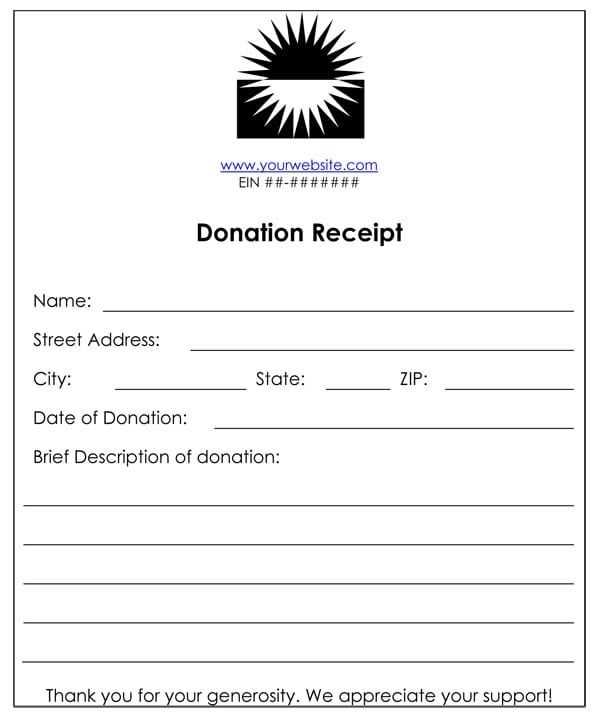

Creating a donation receipt letter in Word is straightforward and ensures your donors receive the proper acknowledgment for their contributions. The receipt should include key details that confirm the donation’s legitimacy and provide necessary tax information. Here’s a step-by-step guide on creating a simple yet professional donation receipt.

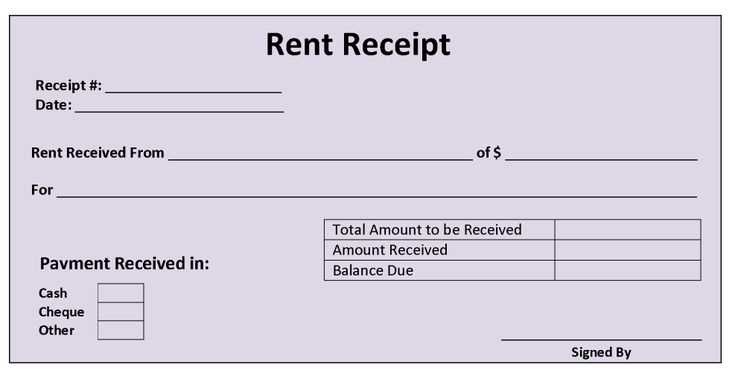

How to Create a Basic Receipt in Word

Start by opening a new Word document and selecting a clean, professional template. You can use a basic letter template or create one from scratch. Align the text properly, ensuring the donor’s name, donation amount, and date are clearly visible. Use consistent fonts and size for readability, and leave ample space for signatures if needed.

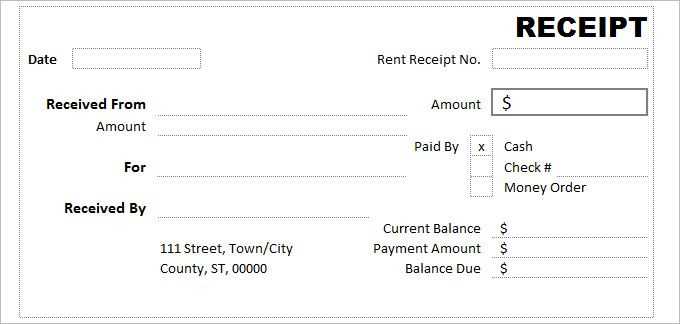

Key Information to Include in the Receipt

Your donation receipt should cover the following points:

- Donor’s name and address.

- Organization’s name and address.

- Date of donation.

- Amount or value of the donation (or description if it’s an in-kind donation).

- A statement confirming no goods or services were exchanged in return (if applicable).

- Your nonprofit’s tax-exempt status (e.g., 501(c)(3) in the U.S.).

Ensure these elements are easy to find and presented clearly.

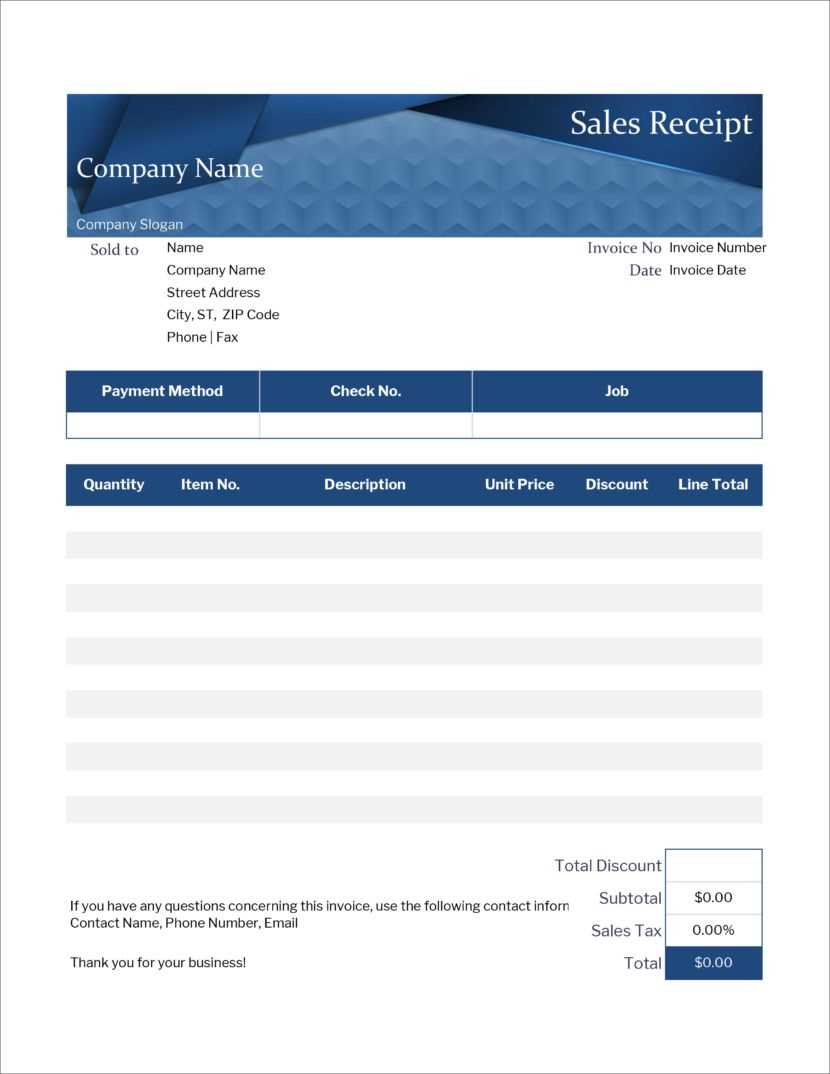

Formatting Tips for a Professional Donation Letter

To make your letter stand out, consider using the following formatting tips:

- Choose a simple, professional font such as Arial or Times New Roman.

- Use bold headers to separate sections and guide the reader.

- Keep the layout clean with consistent margins and spacing for readability.

- Add your nonprofit’s logo or branding to enhance the professionalism.

Customizing the Receipt Template for Different Donors

Tailor the receipt template based on the donor’s contribution. For cash donations, just include the amount and the date. For in-kind donations, be specific about the items donated and their estimated value. If you’re dealing with large donations, you might want to include more personalized messaging to acknowledge their support.

How to Add Legal and Tax Details to a Receipt

Ensure your receipt includes legal statements required by your local tax authorities. In the U.S., for example, IRS guidelines specify that a donation receipt must include the organization’s tax-exempt status and a clear statement that no goods or services were exchanged for the donation. Include a phrase like: “No goods or services were provided in exchange for this contribution.” This is necessary for donors to claim tax deductions.

Best Practices for Sending Receipts to Donors

Send donation receipts as soon as possible after the contribution is made. Emailing receipts is the most efficient method, but if you’re sending paper copies, use a formal letterhead for a more polished look. Consider tracking all receipts and keeping records of every transaction for your nonprofit’s tax purposes. Offering receipts in PDF format allows donors to keep a digital copy for easy reference during tax season.