How to Create a Donation Receipt in Word

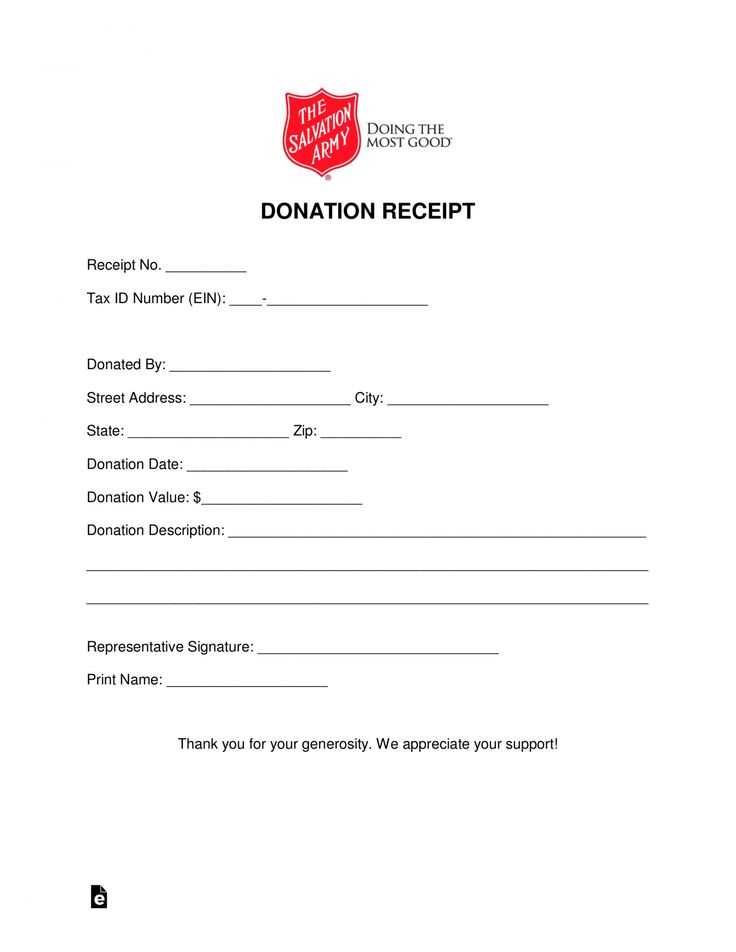

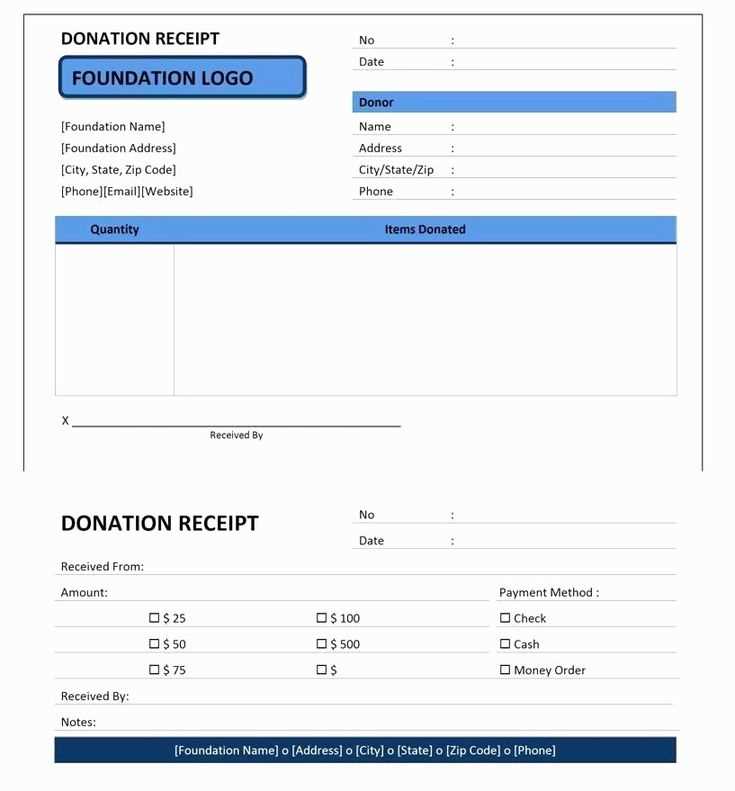

Use a structured format to ensure clarity. Open a new document in Word and follow these steps:

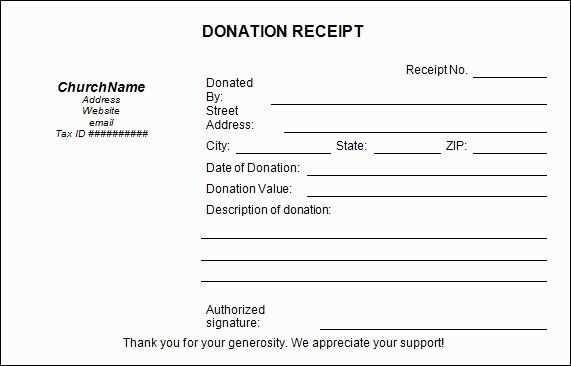

- Header: Include the organization’s name, address, phone number, and email.

- Title: Use “Donation Receipt” to make the purpose clear.

- Donor Information: Add the donor’s name, contact details, and address.

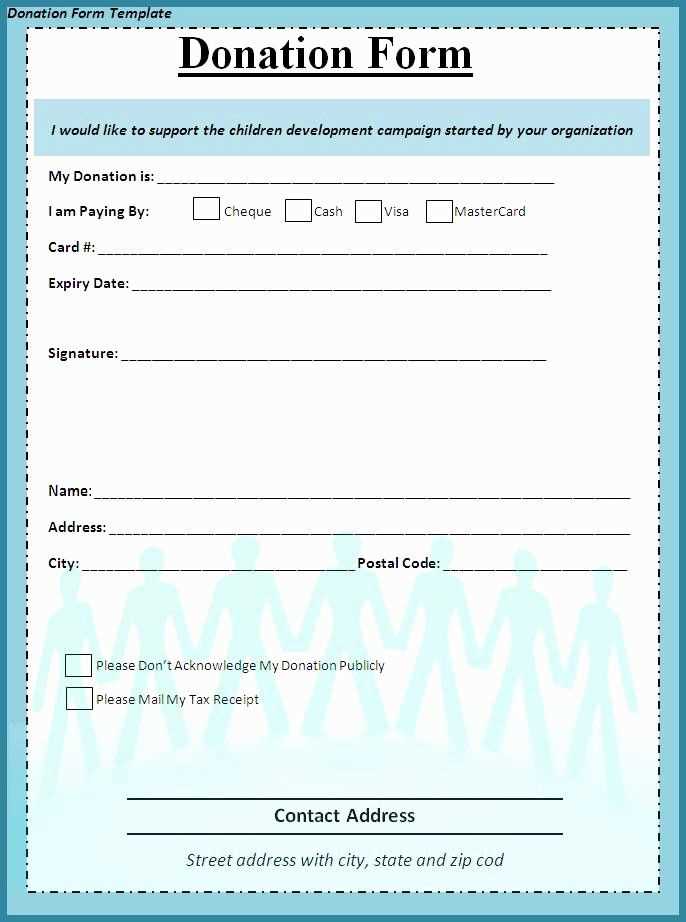

- Donation Details: Specify the date, amount, and type of donation (cash, check, or goods).

- Tax Statement: Mention whether the donation is tax-deductible.

- Signature Section: Leave space for an authorized signature.

Key Elements to Include

- Date: Essential for tax documentation.

- Receipt Number: Useful for record-keeping.

- Description of Goods: If non-monetary, provide item details and estimated value.

- Legal Disclaimer: State that no goods or services were exchanged, if applicable.

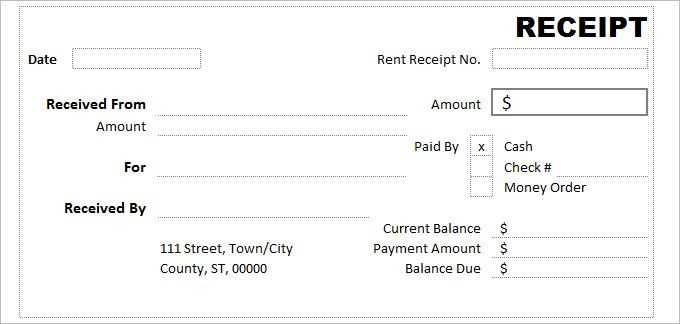

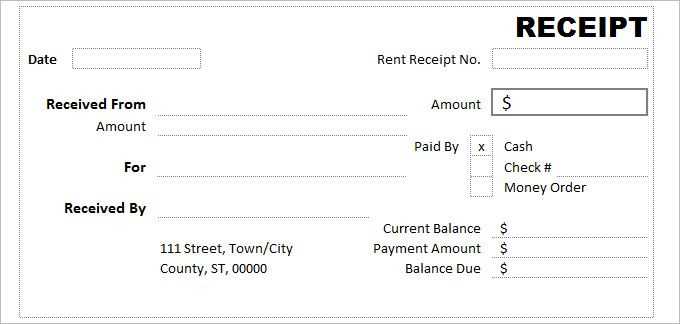

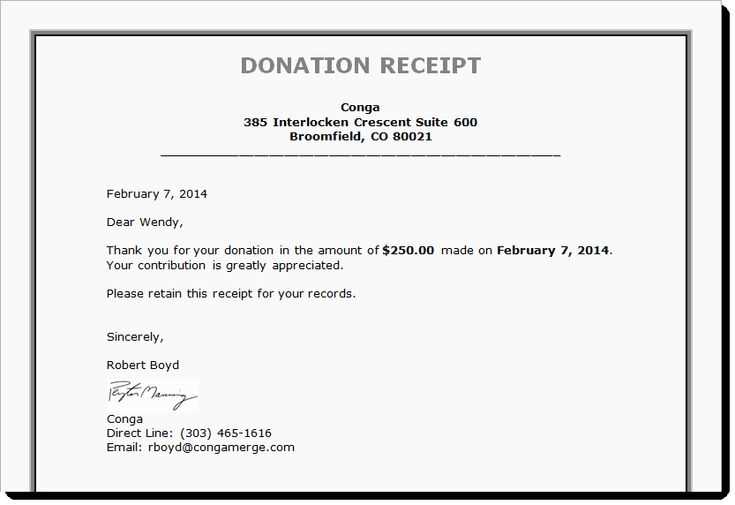

Example Format

A basic layout can look like this:

Organization Name

Address | Phone | Email

Donation Receipt

Donor: [Full Name]

Date: [MM/DD/YYYY]

Amount: $[Amount] (or Description of Goods)

Receipt Number: [Unique ID]

No goods or services were provided in exchange for this donation. This receipt serves as proof of contribution.

Authorized Signature: ________________

Finalizing the Template

Save the document as a reusable template in Word. Adjust formatting for a professional appearance, using bold headers and clear spacing. If needed, convert the file to PDF before sharing.

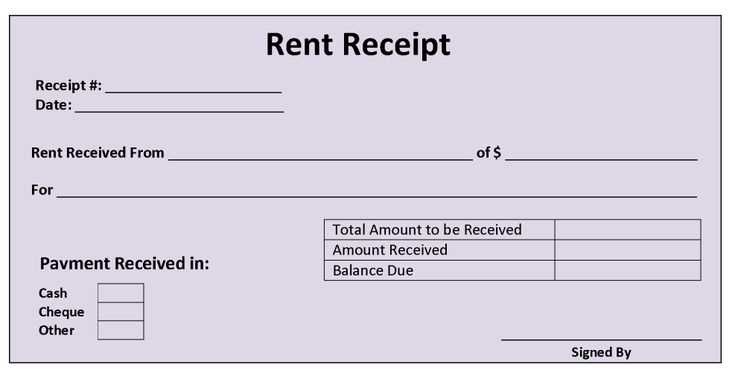

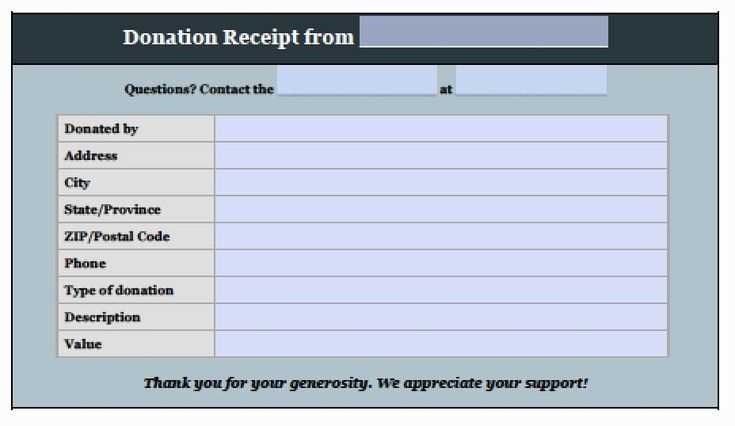

Donation Receipt Template in Word

Include the organization’s name, address, and contact details at the top. The donor’s name and contact information should be clearly stated.

Specify the donation amount or describe the donated item. If it’s a non-cash donation, provide an accurate description and note that the donor is responsible for determining its value.

State the donation date and confirm whether the donor received any goods or services in return. If no benefits were given, include a statement confirming the donation is fully tax-deductible.

Use a formal closing with an authorized signature and a thank-you message. Keep the format simple for easy customization and readability.