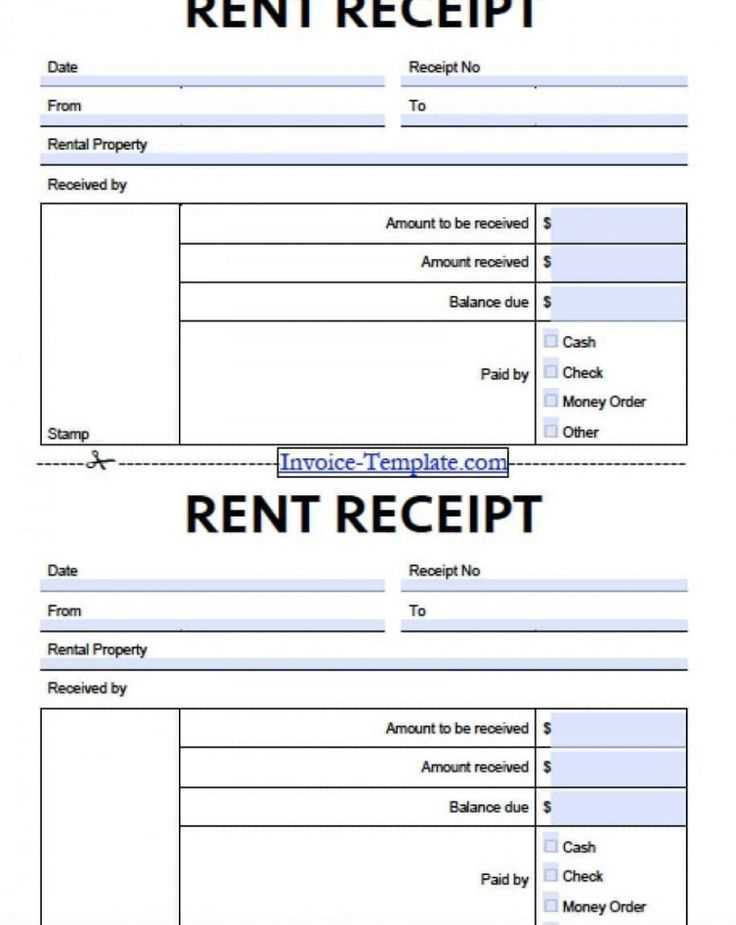

A business ownership transfer document must clearly outline the terms and conditions of the transfer. A receipt template can be useful to confirm the legal aspects of the transfer, ensuring both parties agree to the terms. This document serves as evidence that the transfer has been completed and accepted. The template should include key information like the names of both parties, the date of the transfer, the type of business involved, and any payment or consideration agreed upon.

Using a well-structured receipt template ensures that both the buyer and the seller have a reference for future disputes or clarifications. The template should be customizable to accommodate various business types and transaction details. A clear format will help prevent any misunderstandings about the specifics of the agreement, including ownership percentages, intellectual property, and liabilities, if applicable.

Ensure the template also includes a section for signatures, as this is essential for legal validity. A template made in Word format allows for easy editing and can be tailored to specific situations. This makes it easier for both parties to finalize the transaction without unnecessary delays or confusion.

Here are the corrected lines with duplicates removed:

Review your document for unnecessary repetitions in the clauses. Ensure that each statement is clear and concise. Eliminate redundant language to make the agreement more straightforward and professional.

For example, instead of repeating the ownership transfer details multiple times, consolidate them into one section. This reduces clutter and makes the document easier to understand.

Ensure that each term used is defined clearly the first time and avoid restating definitions unnecessarily. This keeps the contract focused and precise.

If the document includes similar clauses, combine them under a single heading to streamline the content. This helps the reader follow the structure without confusion.

Finally, read through the document to check for phrases that may be implied and can be omitted to reduce length and complexity.

- Legal Document for Business Ownership Transfer Receipt Template in Word

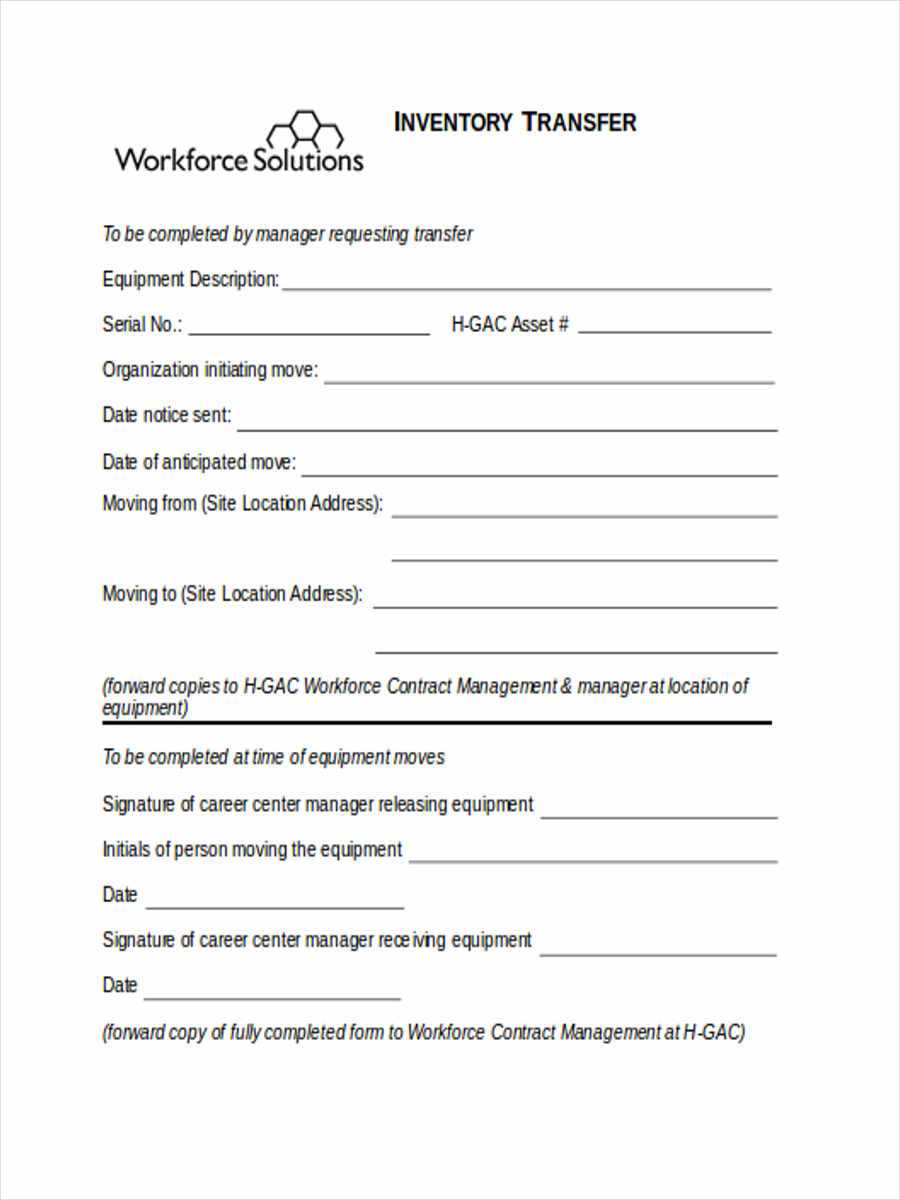

Use a formal business document template when transferring ownership. A receipt template ensures both parties have clear evidence of the transaction. This template should include the business name, the names of the transferor and transferee, the agreed transfer date, and a detailed description of the ownership being transferred. It also needs to confirm the transfer is legally binding under applicable laws.

The following table outlines the key sections to include in your transfer receipt template:

| Section | Description |

|---|---|

| Transferor Information | Name, address, and contact details of the current owner (Transferor) |

| Transferee Information | Name, address, and contact details of the new owner (Transferee) |

| Business Details | Name of the business, description of the ownership interest being transferred (e.g., shares, assets, etc.) |

| Transfer Date | The specific date on which the ownership is transferred |

| Consideration | Details of any payment or exchange made for the transfer of ownership |

| Signatures | Space for both parties to sign and date the document |

Make sure the document is signed by both parties and witnessed if necessary to comply with legal requirements. The template can be customized in Microsoft Word, allowing you to easily adjust it to specific business transfer needs.

Clearly list the names and contact information of both the buyer and the seller. Ensure that their legal names and addresses are accurate for proper identification.

Include a detailed description of all assets being transferred, such as physical property, intellectual property, contracts, and customer lists. Be explicit about any exclusions or assets not part of the transaction.

Specify the total purchase price and any payment terms. Include details on whether payments will be made in full upfront or in installments. Mention any deposits or down payments already made.

State the transfer date clearly. Indicate the exact date when ownership is legally passed from the seller to the buyer. This is an important reference point for legal purposes.

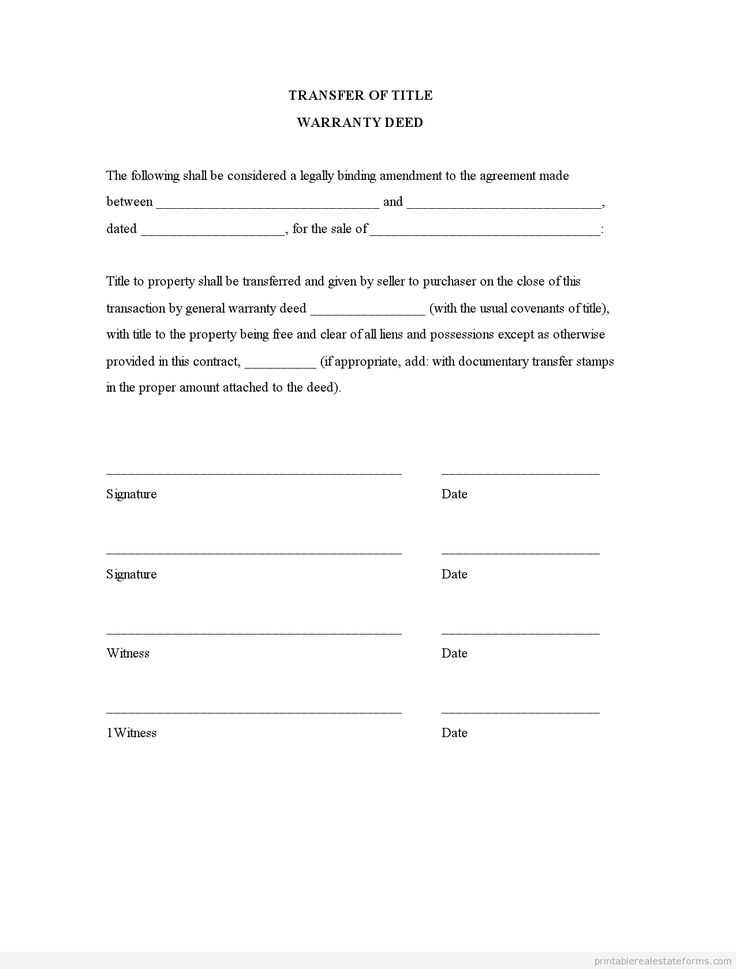

Ensure both parties sign the document. The buyer and seller must sign the receipt to validate the transaction. The signatures confirm that both parties agree to the terms of the transfer.

Begin by opening Microsoft Word and creating a new blank document. Set up the document layout to match the formality of a legal document. Ensure that the margins are consistent, typically 1-inch on all sides, and the text is aligned to the left for a clean and professional look.

1. Title the Document

At the top of the page, clearly state the document’s purpose. Use a bold and straightforward title, such as “Business Ownership Transfer Agreement.” This title sets the tone for the entire document and helps identify its function.

2. Add Parties Involved

Immediately below the title, list the names and roles of the individuals involved in the transfer. Include full legal names, addresses, and any business registration details. Label each party as the “Transferor” (current owner) and the “Transferee” (new owner).

3. Detail the Business Information

Provide a brief description of the business being transferred. Include the official business name, its location, and any registration or tax identification numbers. This section should be clear and precise to avoid any confusion later.

4. Specify Transfer Terms

Outline the key terms of the transfer, such as the agreed-upon sale price, payment terms, and any other compensation involved. If applicable, mention any warranties or representations made by either party regarding the business assets or liabilities.

5. Outline the Transfer of Assets

Specify what assets are being transferred, including physical property, intellectual property, or any other items related to the business. Be clear about what remains with the transferor and what is handed over to the transferee.

6. Date of Transfer

State the exact date when the transfer becomes effective. This is crucial for legal purposes, as it establishes the timeline of ownership change.

7. Include Signatures

Conclude the document with spaces for both parties to sign and date the agreement. Consider adding witness lines if required by your jurisdiction. Signatures confirm that both parties agree to the terms outlined in the document.

8. Review and Finalize

Before finalizing the document, review it for accuracy and completeness. Make sure all details are correct and that both parties fully understand the terms of the transfer. After any necessary revisions, save the document and prepare it for printing or electronic distribution.

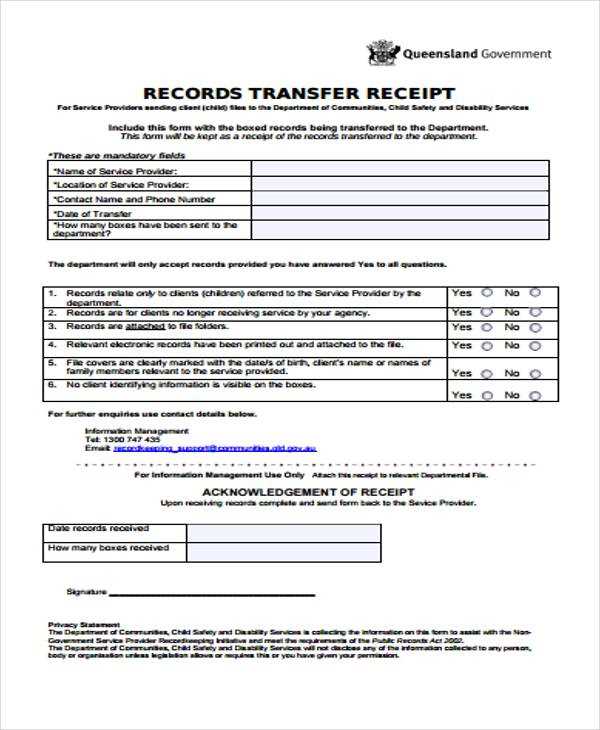

Begin by clearly identifying the parties involved in the transfer. The full names of both the seller and the buyer must be accurately stated, including their legal business entities, if applicable. This ensures that the receipt is legally binding and that all parties are easily identifiable.

Ownership and Assets

Detail the specific assets being transferred, such as intellectual property, equipment, contracts, or inventory. Each asset should be described in precise terms to avoid ambiguity. This helps prevent potential disputes about which items are included in the transfer.

Transfer Conditions

Clearly outline any conditions tied to the transfer, such as the completion of payment or the fulfillment of any pending obligations. Both parties should agree on these terms, and the receipt should reflect any agreed-upon deadlines or milestones.

Additionally, include the effective date of the transfer. This date marks when the business officially changes ownership and is important for both financial and legal purposes.

Liabilities and Warranties

Specify any liabilities or warranties being assumed by the buyer. This may include debt, contractual obligations, or guarantees related to the business. Both parties must agree on who will bear responsibility for these items after the transfer takes effect.

By carefully outlining these points, the receipt will not only serve as proof of the transaction but also protect both parties from future legal issues.

Adapt the template based on the transfer’s nature. For a sale, clearly state the agreed price, payment terms, and any warranties. If it’s a gift or inheritance, outline the absence of compensation and focus on ownership transfer details. When transferring to a family member or partner, specify any unique conditions like ongoing involvement or operational roles post-transfer.

Ensure all business assets and liabilities are clearly listed. Modify sections that refer to ownership percentages if the transfer is partial, such as in partnerships or joint ventures. For asset-only transfers, remove sections irrelevant to ownership, like employee agreements or intellectual property rights, and focus on tangible assets like equipment or property.

Update the section for the transfer of intellectual property to reflect copyrights, trademarks, and patents if applicable. Be specific about what rights are being transferred and any restrictions tied to them. In case of a franchise transfer, adjust the sections to include terms related to franchise agreements and operational guidelines.

Lastly, check the legal language. Tailor clauses to the transfer’s specifics, ensuring they meet state or local legal requirements. Modify sections about dispute resolution to suit the nature of the transfer and parties involved. Keep language clear and concise, particularly for tax-related terms and obligations.

One common mistake is neglecting to specify all terms related to payment. Ensure the agreement clearly outlines the payment structure, including amount, schedule, and method. Ambiguity in financial terms can lead to future disputes.

1. Overlooking Liabilities and Debts

Another mistake is failing to detail who is responsible for existing liabilities or debts. Both parties should agree on how outstanding financial obligations, such as loans or taxes, will be handled post-transfer. Clear allocation of responsibility can prevent legal complications later.

2. Ignoring Required Approvals

Not obtaining the necessary regulatory or third-party approvals is another error. Depending on the business structure and industry, certain approvals may be mandatory before ownership can be transferred. Make sure all required consents are obtained and documented in the agreement.

For instance, in some sectors, government agencies or business partners may need to provide approval before a change in ownership can take effect. Missing this step can cause delays or even invalidate the transfer.

Review the specific laws governing business transfers in your region. Research and integrate key legal requirements that apply to ownership transfer documents.

- Confirm that the template includes all mandatory fields as required by local authorities, such as buyer and seller details, terms of sale, and signatures.

- Ensure the template reflects the legal language and terms recognized by the jurisdiction. Some regions may require specific legal terminology to validate the document.

- Check if there are any notary requirements or third-party witnesses for business ownership transfers in your area. If so, include spaces for signatures and stamps.

- Consult with a local attorney or legal expert to verify the document’s compliance. They can confirm if the template adheres to current legal standards and regulations.

- Stay updated on any changes to local business laws, and adjust the template accordingly to maintain its validity.

By following these steps, you ensure the template meets all local legal standards and minimizes the risk of invalidation during the business transfer process.

To create an effective business ownership transfer receipt template, consider the following guidelines:

- Include clear identification of the parties involved: buyer, seller, and any witnesses or legal representatives.

- Ensure the document specifies the exact date of the transfer, along with the agreed terms such as payment amount and any conditions attached to the transfer.

- Clearly outline the details of the business being transferred: name, address, and registration number.

- Use numbered points to describe the specific assets or liabilities being transferred, if applicable.

Key Elements to Include

- Contact information of all parties.

- Business registration details.

- Transfer terms and conditions, with emphasis on payment details and timelines.

- Signatures of all involved parties with dates to validate the transaction.

Considerations for Formatting

- Make the template easily editable to accommodate variations in transfer details.

- Use a professional, neutral tone throughout the document.

- Ensure that all legal and business terms are clearly defined to avoid ambiguity.