Ready-to-Use Template for Lost Receipts

Download a structured missing receipt form in Word format to document lost purchase receipts. A well-designed form ensures accurate records for reimbursement and financial tracking.

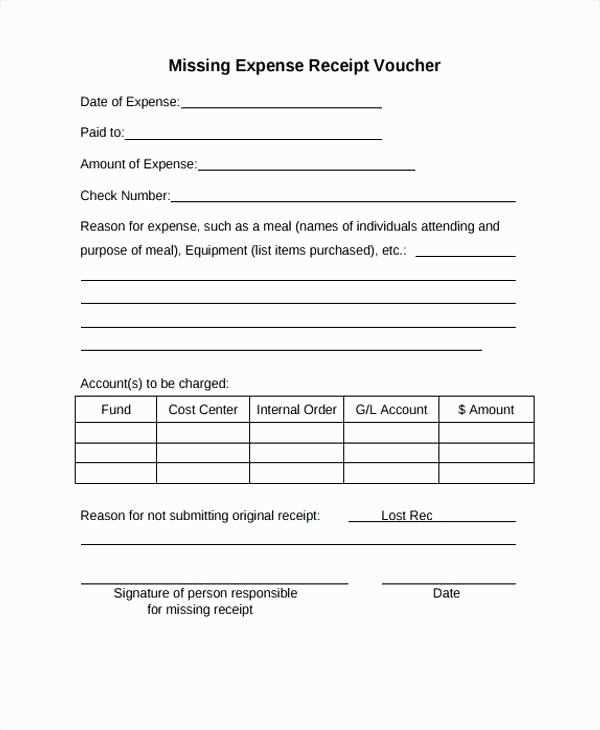

Key Elements of a Missing Receipt Form

- Date of Purchase: The exact date when the transaction took place.

- Vendor Information: Name, address, and contact details of the seller.

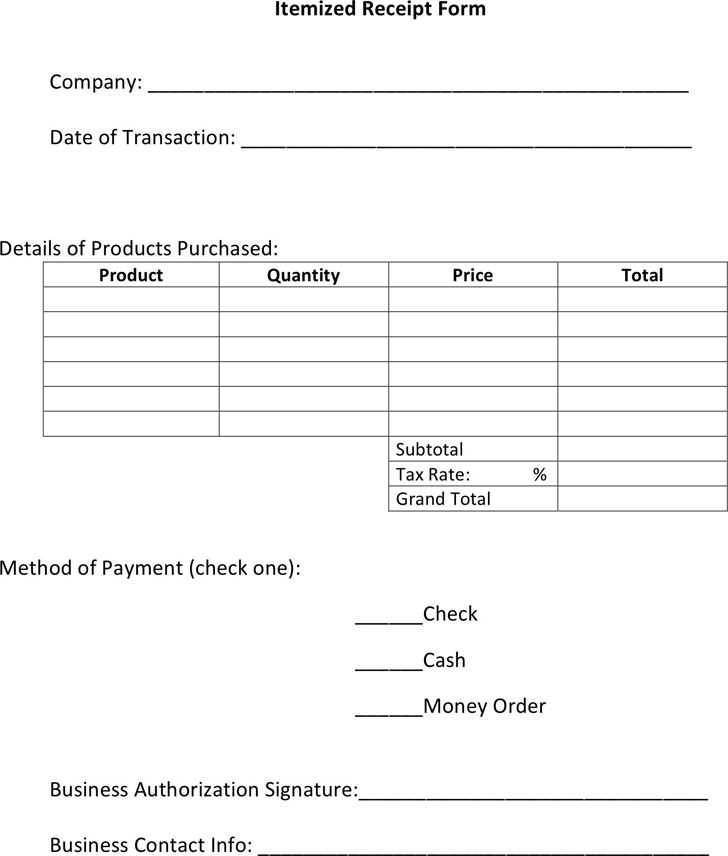

- Itemized Description: A list of purchased goods or services.

- Total Amount: The exact amount paid, including taxes.

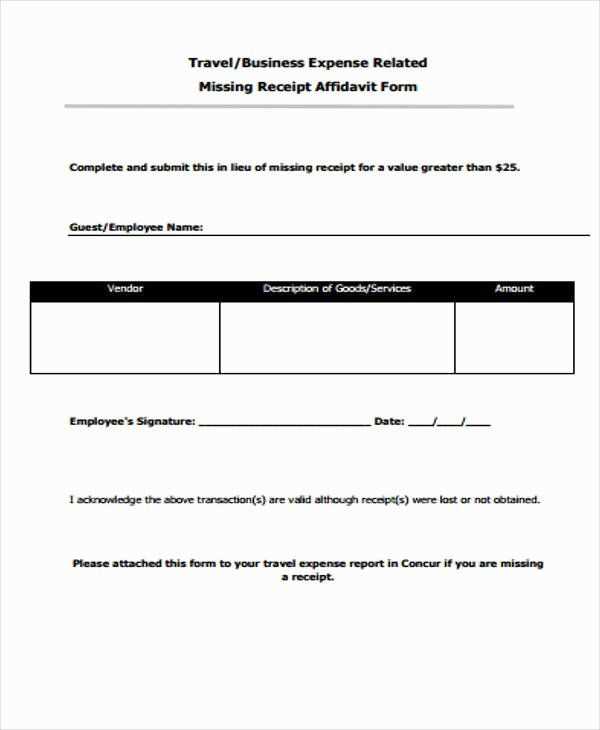

- Reason for Missing Receipt: A brief explanation of why the receipt is unavailable.

- Approval Signature: Authorized personnel must sign to validate the request.

How to Customize the Template

- Open the document in Microsoft Word.

- Modify company details and formatting as needed.

- Add required fields or remove unnecessary sections.

- Save the file as a template for future use.

- Print copies or share the digital form for easy submission.

A properly filled missing receipt form helps maintain compliance with financial policies and simplifies reimbursement requests.

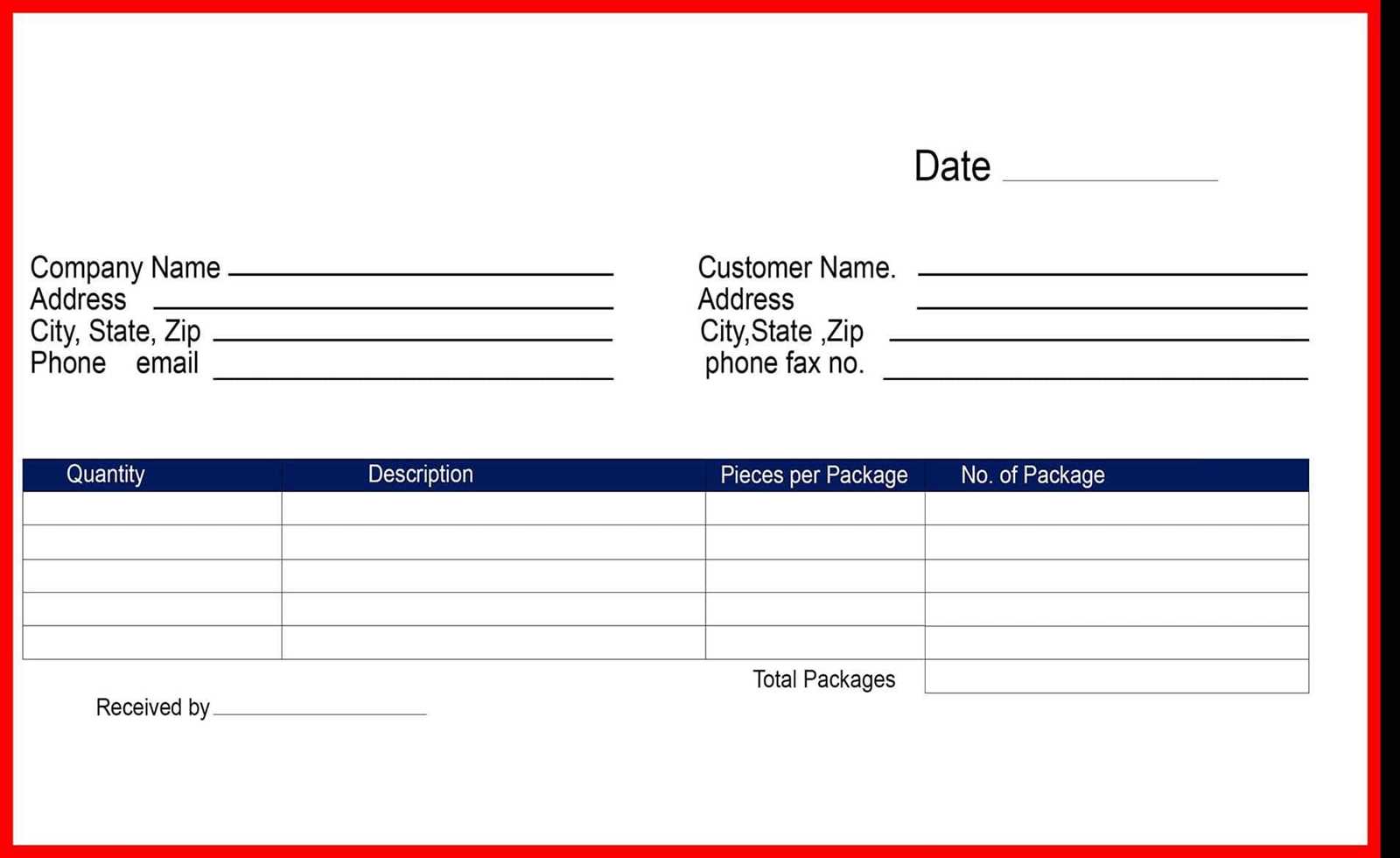

Missing Receipt Form Template in Word

Key Elements of This Document

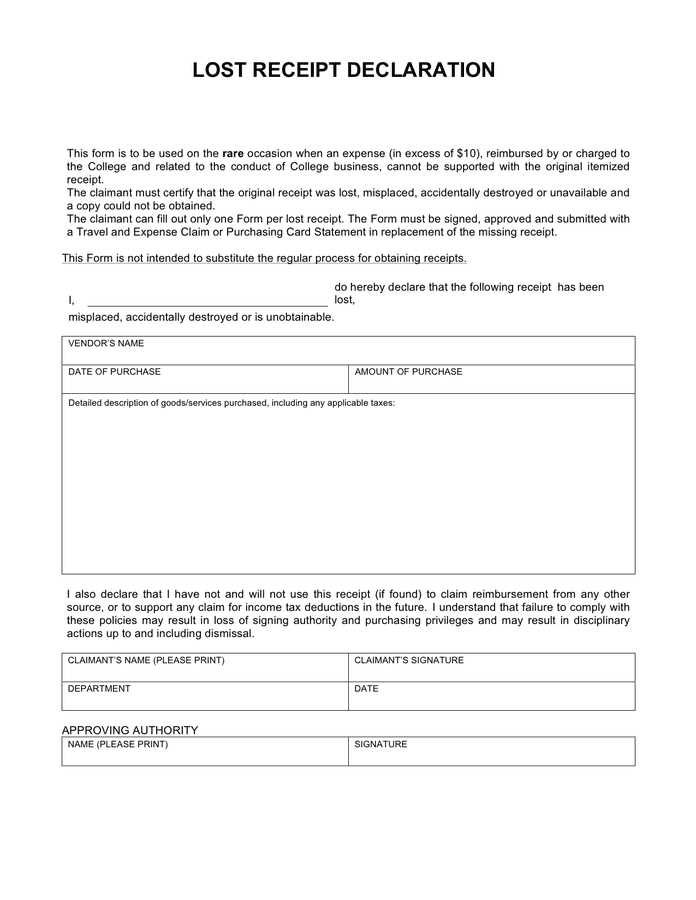

A well-structured missing receipt form should include essential details to validate the expense. Ensure it has fields for the transaction date, vendor name, total amount, payment method, and a brief justification. Adding an employee signature section and an approval field strengthens accountability.

Step-by-Step Guide to Creating a Template

Start with a blank Word document and insert a table for structured input fields. Label columns clearly, including categories for date, vendor, amount, and reason. Use checkboxes for payment methods to streamline selection. Lastly, insert signature lines for both the requester and approver to ensure compliance.

Customizing for Various Business Needs

Adjust the template based on company policies. For travel-related expenses, add fields for trip details and purpose. If used in procurement, include an itemized list. Modify approval levels by inserting additional signatory sections when required.

Legal and Accounting Aspects

Ensure the template meets tax and audit requirements by aligning it with company expense policies. Retain records for the mandated period to support financial reporting. Using pre-approved wording for declarations can prevent discrepancies during audits.

Common Mistakes to Avoid in Usage

Skipping mandatory fields weakens the document’s validity. Always double-check for missing signatures before submission. Avoid vague justifications–specificity improves approval rates. Ensure scanned copies are legible if stored digitally.

Best Practices for Record-Keeping and Approval

Maintain digital backups to prevent data loss. Implement a standardized naming convention for quick retrieval. Require regular reconciliation with accounting records to detect inconsistencies early. Automating submission processes with digital signatures can further enhance efficiency.