If you need a quick and reliable way to create a cash deposit receipt, an MS Word template can be your best solution. With just a few clicks, you can generate a professional-looking document that meets both personal and business needs. These templates are highly customizable, allowing you to adjust details like the deposit amount, date, and recipient’s name easily.

Choosing a template designed for cash deposits helps streamline the process of documenting financial transactions. You don’t have to worry about missing key information, as most templates include predefined sections for crucial details. Tailor the format to suit your specific requirements, whether it’s for your own records or for providing a receipt to a customer.

It’s best to ensure that your cash deposit receipt includes all necessary details–such as the deposit source, amount, and purpose of the transaction. This way, you can avoid any confusion down the line. With an MS Word template, the document can be saved, printed, or shared digitally within minutes.

Having a standard format for cash deposits reduces the chances of error and provides a consistent, professional look for your business or personal finances. By leveraging MS Word templates, you save time while maintaining organization in your financial records.

Here’s the corrected version without word repetition, maintaining meaning and structure:

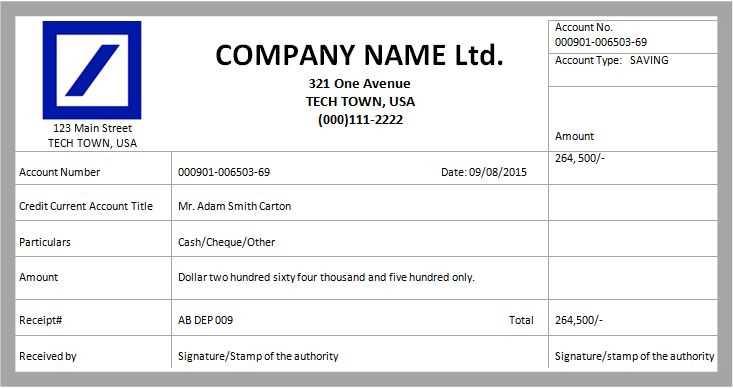

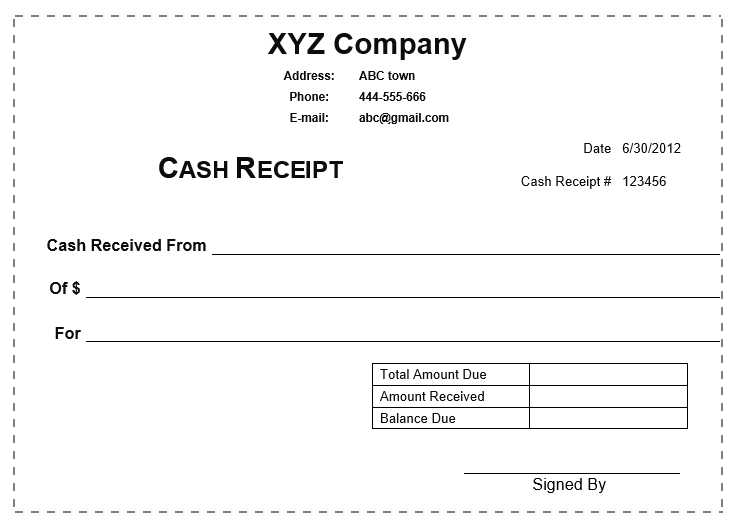

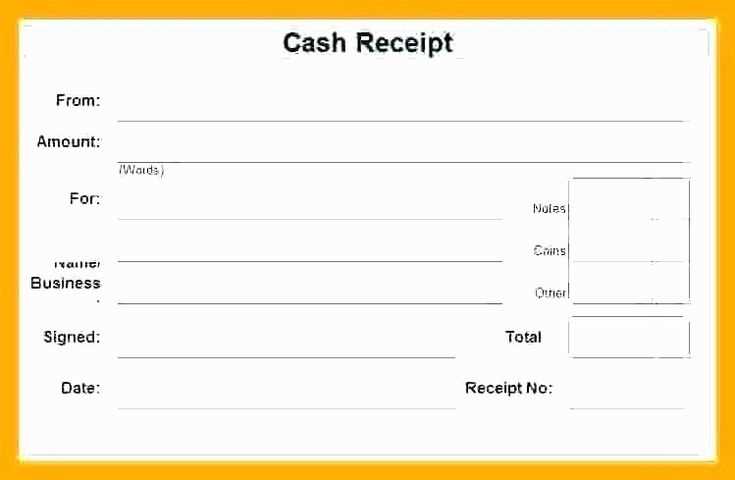

To create an accurate cash deposit receipt template in MS Word, focus on these key elements:

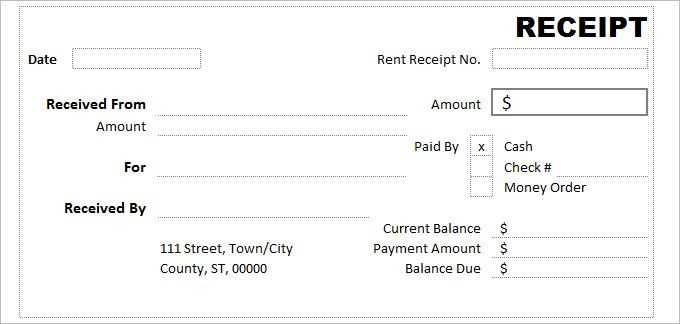

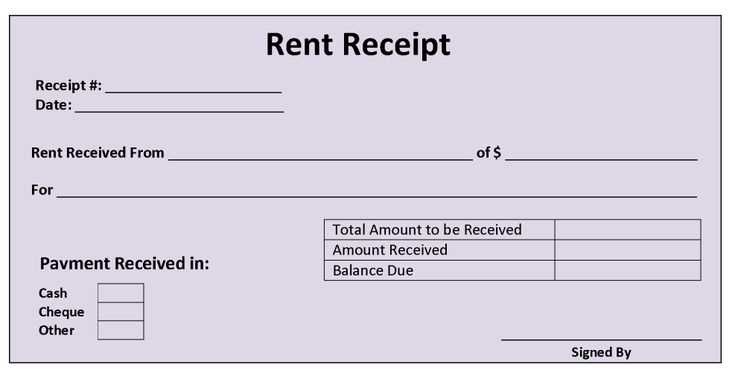

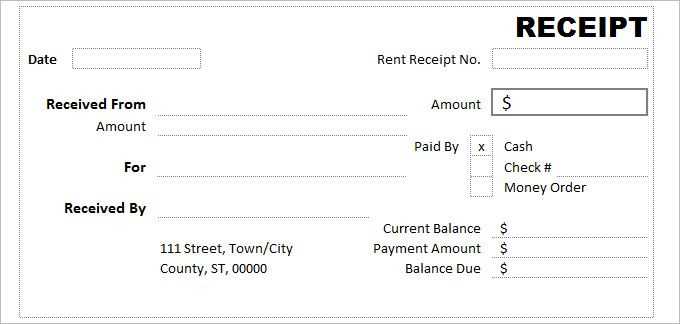

1. Header: Include a clear heading at the top, such as “Cash Deposit Receipt” or “Deposit Receipt”. Make sure it stands out, ideally in bold, and centered on the page.

2. Date and Time: Provide the deposit date and time for reference. This will help track the deposit’s occurrence accurately.

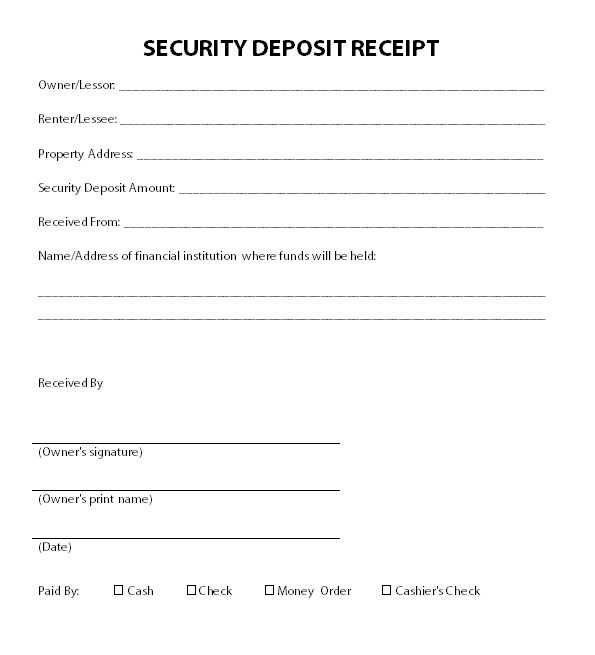

3. Depositor Information: Add the name and contact details of the person making the deposit. If applicable, include the account number or ID for identification purposes.

4. Amount Deposited: Clearly state the exact cash amount. You can break this down into units for clarity, such as “Amount in Words” and “Amount in Figures”.

5. Depository Information: Include the details of the receiving party or business entity, such as the name of the financial institution or company.

6. Signature: Add a space for both the depositor and the receiver to sign the document. This adds a layer of verification and authenticity.

7. Footer: Consider including a footer with additional notes or terms. This can be useful for providing legal disclaimers or reminding the parties of any relevant policies.

By organizing the template in this way, the document remains clear, professional, and effective without redundancy. Keep each section brief yet informative to enhance usability and readability.

- MS-Word Cash Deposit Receipt Template Guide

Creating a cash deposit receipt in MS Word is straightforward. Here’s how you can set up a simple, clear template for documenting deposits.

- Start with a Blank Document: Open Microsoft Word and create a new blank document. This will give you the freedom to design your template as needed.

- Header Details: Include the name of your business or institution at the top. You can use the “Header” feature in Word for consistency. Add the address, phone number, and website beneath the name. This should be formatted in a clear, professional font.

- Receipt Title: Title the document as “Cash Deposit Receipt” or “Deposit Confirmation”. This ensures the purpose of the receipt is immediately clear.

- Receipt Number: Add a unique receipt number for tracking purposes. Place this in a prominent location, such as at the top-right corner, to maintain an organized filing system.

- Deposit Information: Include a section for the following details:

- Date of deposit

- Amount of cash deposited

- Depositor’s name and contact details

- Account or reference number if applicable

- Signature Section: Leave space for the person receiving the deposit to sign, confirming the transaction. This should be placed at the bottom of the template.

- Additional Notes: Include a section at the bottom for any extra information like transaction fees, specific terms, or notes about the deposit.

- Format and Style: Use tables to organize the receipt clearly, aligning text for readability. Choose legible fonts like Arial or Times New Roman and avoid clutter. Adjust margins to ensure the receipt fits neatly on the page.

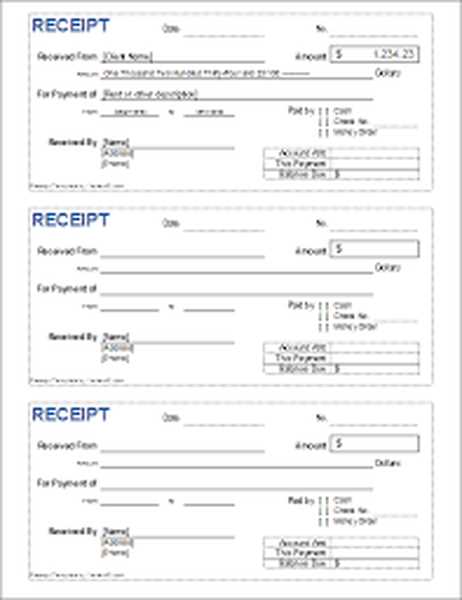

- Save as Template: Once you’ve designed the layout, save the document as a template (.dotx file). This way, you can easily reuse it without recreating the structure each time.

This basic guide will help you create a functional and professional cash deposit receipt template in MS Word. Customize the fields as needed to fit your business requirements.

Open MS Word and select a blank document. Begin by adding the necessary header for the receipt, such as “Deposit Receipt” or “Cash Deposit Receipt.” Use a bold font and larger size for easy identification.

Next, insert a table with two columns. The first column will contain labels for the fields you need, such as “Date,” “Deposit Amount,” “Depositor Name,” “Account Number,” and “Transaction ID.” The second column will leave space for the corresponding information. Adjust the column widths to make sure everything is neatly aligned.

Under the table, include a section for any additional notes or terms related to the deposit, like “Depositor’s signature” or “Processed by.” This can be placed in a smaller font size to distinguish it from the rest of the text.

To improve the template’s look, use borders for the table and align the text in the center. You may also choose to add a footer with your company’s name and contact details. Keep the layout simple and clear so that it’s easy to fill out.

Save the document as a template so you can use it repeatedly without needing to recreate the structure. When filling out the receipt, just replace the placeholders with the specific transaction details.

For precise tracking, adjust the fields for “Amount” and “Date” in your receipt template. First, for the “Amount” field, make sure the input box is large enough to accommodate the expected value. Use a text box or table cell with clear borders and a placeholder like “Enter Amount” to guide users. Ensure the format reflects the currency you are working with (e.g., USD, EUR), and consider including a currency symbol next to the field to avoid confusion.

For the “Date” field, use a date picker or dropdown menu to simplify entry. Ensure the format is consistent (e.g., MM/DD/YYYY) and clear for anyone filling out the receipt. If your template will be used internationally, you might want to make the date format customizable to match local preferences.

Make both fields responsive and ensure they align properly with other content on the template. Additionally, apply field validation where necessary–such as requiring a valid amount or a date before submission–to maintain accuracy in your records.

Adding Business Details: Logo, Address, and Contact Info

Include your business logo, address, and contact information at the top of the receipt for clear identification. This makes your business instantly recognizable and provides recipients with the necessary details to get in touch with you easily.

1. Business Logo

Place your logo at the top left or center for optimal visibility. The logo should be clear and of high quality to ensure professional presentation. Keep the file size optimized to avoid delays in document loading.

2. Business Address

Directly below the logo or at the top right corner, list your business address. Make sure to include the street, city, state, and ZIP code. If applicable, include any suite or floor numbers. A complete address ensures clients can reach you without confusion.

3. Contact Information

Under the address or aligned with it, display your phone number, email, and website. Make sure these contact methods are accurate and regularly monitored. Providing multiple contact options helps clients choose the most convenient way to reach you.

- Phone: Include a local or toll-free number.

- Email: A dedicated support email is recommended for quick responses.

- Website: If relevant, add a link to your business website for further details.

By incorporating these elements clearly and professionally, you ensure customers can contact your business easily and confidently.

To ensure smooth tracking and verification of deposits, always include the Deposit Reference and Transaction IDs on your receipt template. These identifiers help both the sender and receiver to cross-check the transaction details and provide clear evidence for any future inquiries or disputes.

Position the Deposit Reference and Transaction IDs in a prominent section of the receipt. These IDs should be easily distinguishable from other information. For example, you can place them directly below the transaction amount or in the receipt header for quick visibility.

| Field | Example |

|---|---|

| Deposit Reference | DEP123456789 |

| Transaction ID | TXN987654321 |

Ensure that the format for both IDs follows a consistent structure. This reduces errors and ensures easier verification. Use a combination of letters and numbers to create a unique string for each transaction, and avoid reusing the same ID for different deposits.

Finally, incorporate a note indicating that these IDs are provided by the financial institution. This clarifies that the reference numbers are official and linked to the actual transaction, increasing trustworthiness.

Use ample white space to ensure readability. Avoid clutter by leaving enough margins around your content. A clean, spacious layout enhances the user experience and directs attention to key information.

Choose a consistent and readable font. Opt for common fonts like Arial, Calibri, or Times New Roman in sizes 10-12 for the body text. Use bold or italics sparingly for emphasis to maintain a polished look.

Align your text consistently. Left alignment is standard for most documents, but centered text can be used for headings or titles. Ensure everything is uniform for a cohesive appearance.

Incorporate a clear hierarchy with headings and subheadings. Use larger fonts or bold text for main sections, while slightly smaller sizes can be used for subheadings. This guides the reader through the content seamlessly.

Keep your formatting simple but structured. Avoid overuse of colors or complex designs that can distract from the content. Use contrasting colors for headings or important details to make them stand out.

Insert tables or borders when appropriate for organizing financial details. Ensure they are easy to read by using clear labels and sufficient spacing between rows and columns.

Finally, check your document for consistency in spacing and alignment. A tidy layout speaks volumes about professionalism and care in presentation.

Save your cash deposit receipt template by choosing “Save As” and selecting a location on your computer. Choose the file type that suits your needs, such as .docx for regular use or .dotx for a template. By saving it as a template, you ensure it’s available for reuse without overwriting the original document.

To reuse your template, open MS Word, go to “File,” and select “Open.” Locate your saved template and open it. When you make a deposit receipt, simply replace the relevant information with new details, keeping the format intact. This way, you avoid reformatting every time you need a new receipt.

If you’re working with a team, store the template in a shared folder or cloud service like OneDrive. This makes it accessible to anyone who needs to use it, ensuring consistency across documents. With this setup, team members can quickly access and reuse the template without confusion.

For future updates to the template, modify the original file and save it again as a template. This allows you to keep it current while maintaining a consistent structure for your cash deposit receipts.

Cash Deposit Receipt Template in MS Word

To create a professional and clear cash deposit receipt in MS Word, begin by opening a blank document. Use a simple table to structure the receipt’s key sections. Start with your organization’s name at the top, followed by the date and transaction number. Next, include the depositor’s name and contact details. This section should be followed by the amount deposited and any applicable reference or transaction number for easy tracking.

For better readability, format the receipt with bold headers for each section. Ensure that the amount deposited is clearly highlighted. This can be achieved by using a larger font size or changing the font style to make it stand out. Add a footer with your organization’s address and contact information for future reference.

Consider including a section for additional notes, such as the purpose of the deposit or any relevant transaction details. This helps to provide context for the deposit and serves as a reference in case of inquiries. Keep the layout simple and direct, ensuring that the important details are easy to find at a glance.

Finally, save the template for reuse and ensure the document is easily editable for future deposits. This method keeps your receipts uniform and professional every time you need to generate one.