Creating a non-cash donation receipt in Word is straightforward and helps maintain proper records for tax purposes. A well-organized template simplifies the process for both the donor and the receiving organization. The receipt should include the donor’s information, a description of the donated items, their estimated value, and the organization’s details.

Start by listing the name and contact details of the donor along with the date of the donation. Specify the items donated, providing enough detail for clarity. Include a note that the donor did not receive any goods or services in exchange for the donation. This is an important detail for tax deductions.

A simple template can be designed in Microsoft Word to ensure consistent formatting. By including all necessary information in a clear, easy-to-read structure, both parties can ensure they are compliant with IRS guidelines. This receipt serves not only as proof of donation but also as a tool for personal record-keeping and future tax filings.

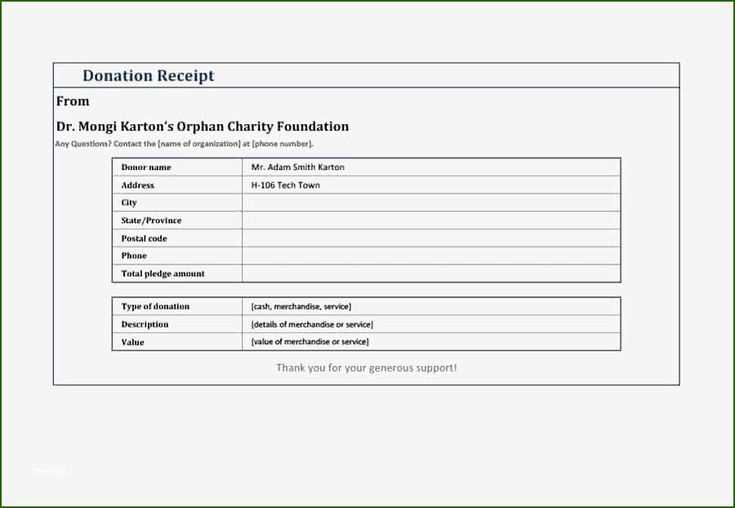

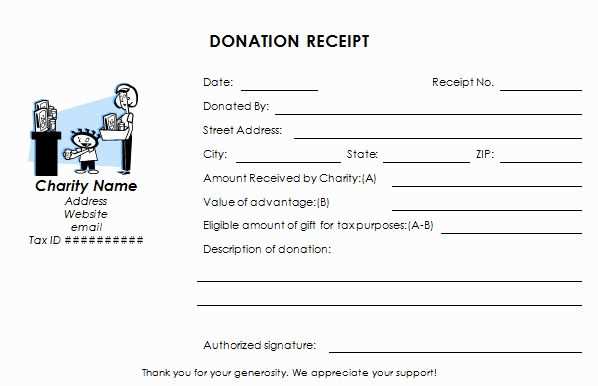

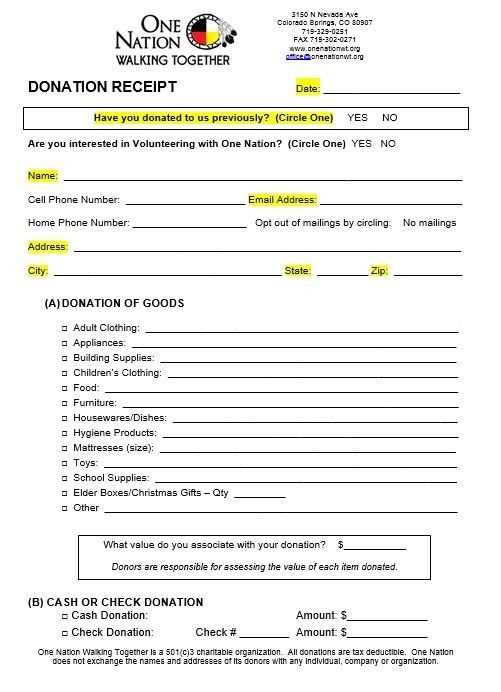

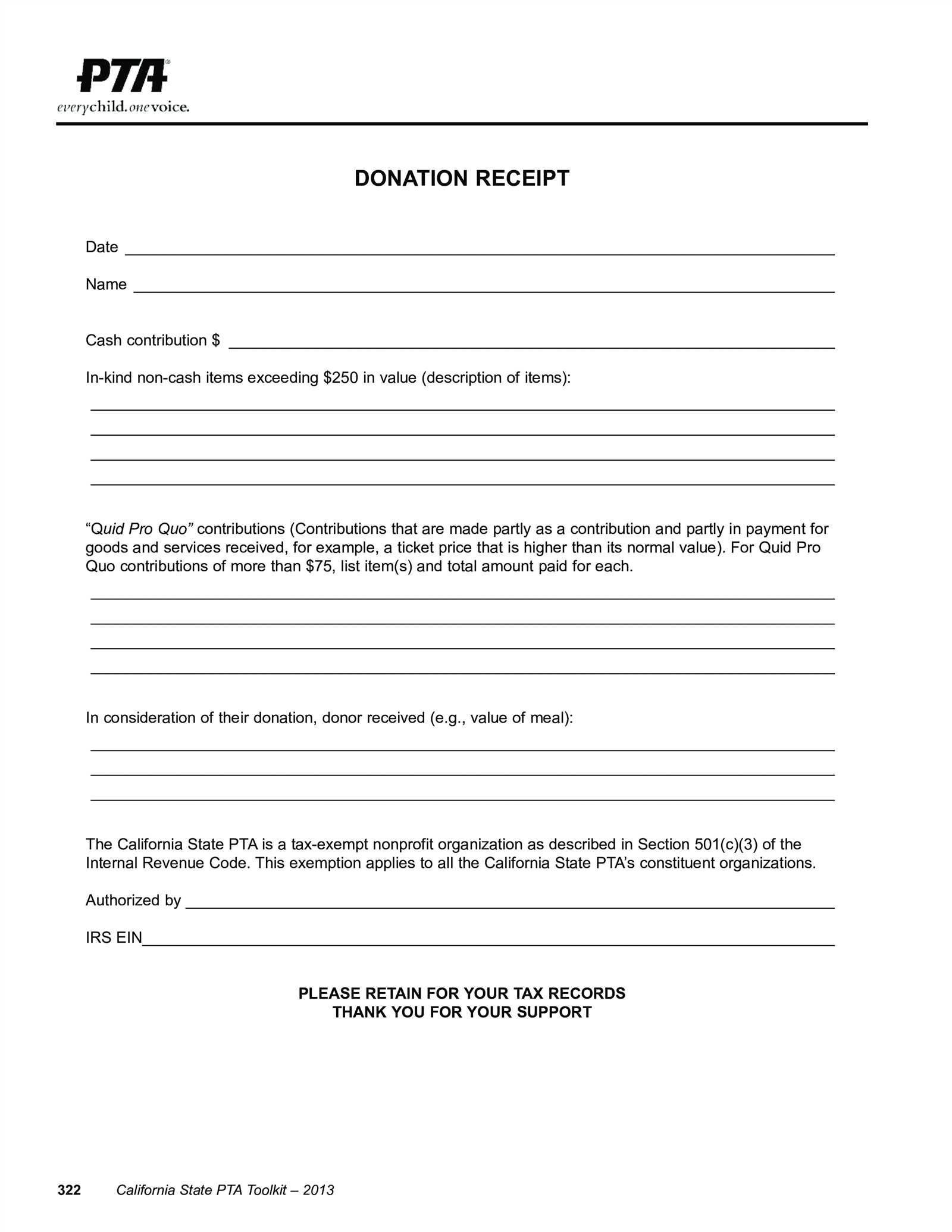

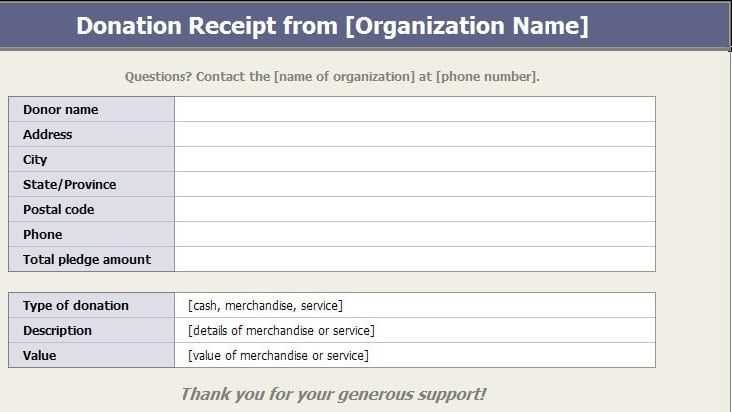

Non Cash Donation Receipt Template in Word

A non-cash donation receipt in Word helps organizations acknowledge and document donations of goods or services. It ensures transparency for donors and serves as a record for tax purposes. The template should include key details such as donor information, description of the donation, and the value of the items donated. A clear format will save time for both the organization and the donor.

Key Components of a Non-Cash Donation Receipt

- Donor Information: Full name, address, and contact details of the donor.

- Organization Information: Name, address, and contact details of the receiving organization.

- Description of Donation: Specific items or services donated, with brief descriptions.

- Value of Donation: A reasonable estimate or appraisal of the donated items, if applicable. The donor is responsible for determining the value.

- Statement of No Goods or Services Provided: A statement confirming that no goods or services were exchanged for the donation.

- Date of Donation: The date the donation was received.

How to Customize a Non-Cash Donation Receipt in Word

- Use a Template: Start with a Word template to ensure all necessary fields are included.

- Insert Logos and Branding: Customize the document with your organization’s logo and branding for consistency and professionalism.

- Editable Fields: Ensure the template includes placeholders for easy editing of donor information and the donation details.

- Simple Formatting: Keep the layout clean and easy to read, with clear sections for each type of information.

By following these steps, you can create a reliable and professional non-cash donation receipt template in Word that helps streamline the process and supports both donors and your organization.

How to Customize a Non Cash Donation Receipt Template for Your Organization

Begin by adding your organization’s name, logo, and contact information at the top of the receipt. This ensures donors can easily identify your nonprofit and reach out if needed. Include your tax identification number (TIN) for legal purposes, especially if donors will use the receipt for tax deductions.

Next, modify the donation description section. Include a clear breakdown of the donated items, including quantity and condition (e.g., new, gently used, etc.). This helps both the donor and your organization keep track of contributions accurately. Include a space for the donor to sign or print their name and date of donation.

For the acknowledgment of the donation’s value, it’s important to leave space for a brief statement that the organization does not provide appraisals. Donors should understand they are responsible for determining the fair market value of their donations. You may also add a disclaimer clarifying that the organization cannot offer tax advice.

Consider a section for any special notes related to the donation, such as restrictions on its use or intended purpose within your organization. This adds clarity in case the donation is earmarked for a specific project or cause.

Finally, include a polite thank-you message. Donors appreciate acknowledgment of their contributions, and a personalized message can encourage continued support.

Steps to Include Accurate Item Descriptions and Fair Market Value in a Receipt

Provide a clear description of each donated item, including brand, model, and condition. Be specific and avoid vague terms like “good condition.” For instance, instead of “used furniture,” write “wooden dining table, slightly scratched, in good working condition.” This helps both the donor and the charity to accurately assess the donation.

Research the fair market value (FMV) of each item to ensure it reflects what similar items would sell for in your local area. Use reliable resources like thrift stores or online marketplaces to determine reasonable pricing. For example, if you are donating a used television, check platforms like eBay or Craigslist to see what comparable models are selling for.

If you cannot assign a precise value, indicate that the FMV is estimated. Mentioning the method used for valuation adds transparency and credibility. For example, “Estimated FMV based on average resale prices for similar items in good condition.” This ensures both parties understand how the value was derived.

Include any relevant details that might affect the value, such as damage, age, or repairs. If the item has significant wear or missing parts, note this, as it will influence the FMV. This avoids confusion during tax filings or audits.

Lastly, make sure the receipt clearly states that the donor is responsible for determining the fair market value. This helps protect the charity from any potential disputes over the estimated value in the future.

Legal Requirements for Non Cash Donations and How to Stay Compliant

To stay compliant with the law when handling non-cash donations, ensure that the donor receives a receipt that includes key information such as the donor’s name, description of the donated items, and their estimated fair market value. A clear, detailed receipt protects both the donor and the organization from potential issues with tax deductions or audits.

Donation Valuation and Documentation

The IRS requires that donated items be valued at their fair market value. Donors must provide their own valuation, but charities should encourage them to use a reputable source for this assessment, especially for higher-value donations. The charity must include the description of the items on the receipt but not their value. This is the donor’s responsibility. For donations exceeding $500, the donor must complete Form 8283 and attach it to their tax return.

Providing Proper Receipts

Receipts for non-cash donations must be issued in a timely manner, typically within a few days of the donation. The receipt should clearly state that no goods or services were exchanged for the donation unless applicable (such as for a charity auction). Make sure to retain a copy of the receipt for your organization’s records, as this will be needed for IRS compliance purposes if any questions arise about the donation.