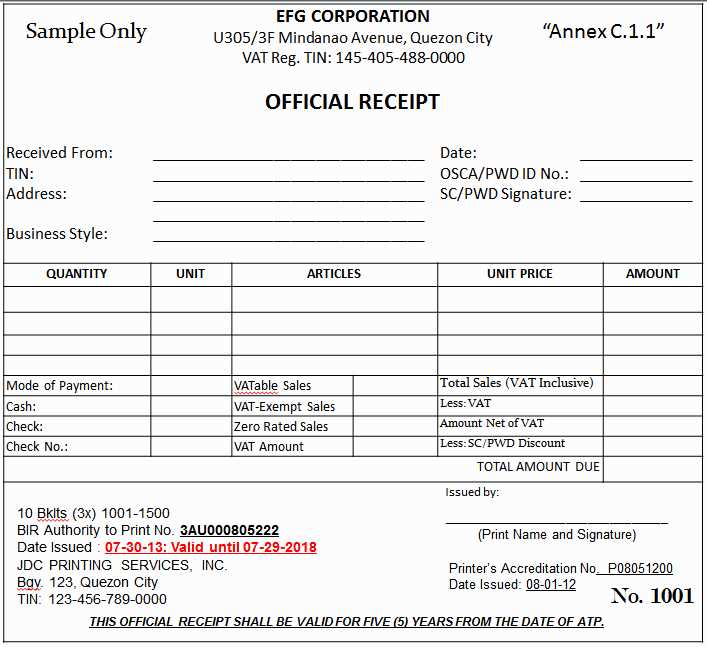

For businesses in the Philippines, using an official receipt template in Word can streamline documentation and ensure compliance with tax regulations. Customize the template with your business logo, contact details, and a unique receipt number to keep records organized.

Incorporate the necessary fields such as transaction date, item description, amount, and payment method. It’s helpful to include VAT information if applicable, ensuring that your receipts meet local requirements. Make sure the format is clear and easy to read for both your team and clients.

Consistency in using an official receipt template helps maintain professionalism and transparency in all transactions. Adjust the layout as needed to fit the nature of your business, and always keep digital copies for backup and easy reference.

Remember to regularly update your template to reflect any changes in tax laws or business practices, so your receipts remain valid and aligned with regulatory standards.

Sure! Here’s the revised version:

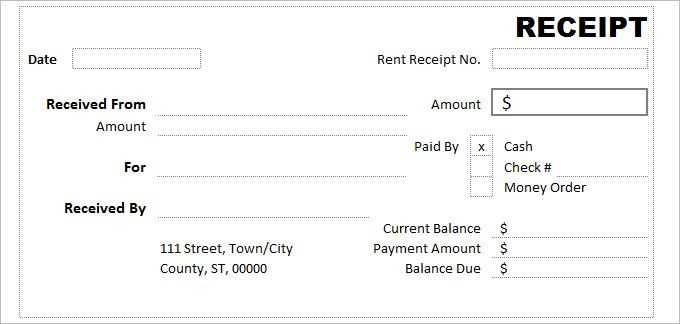

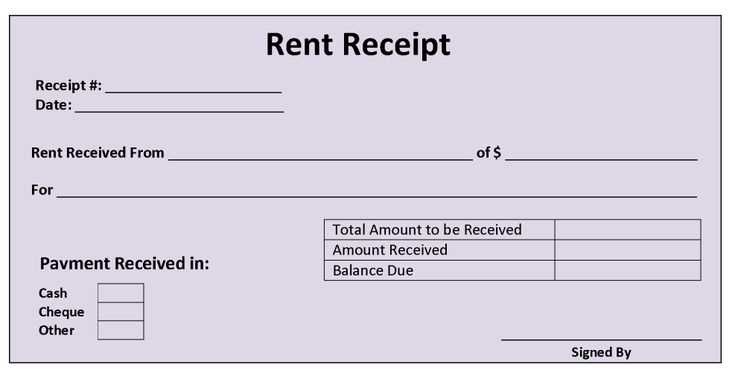

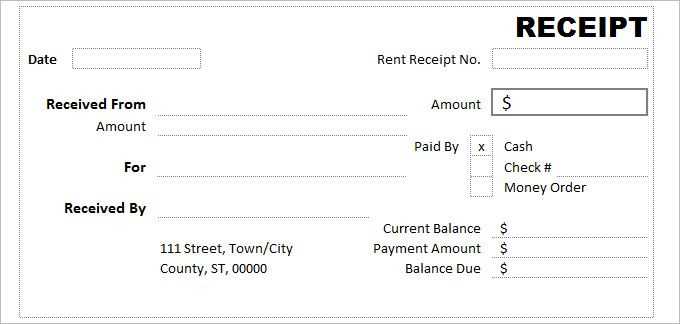

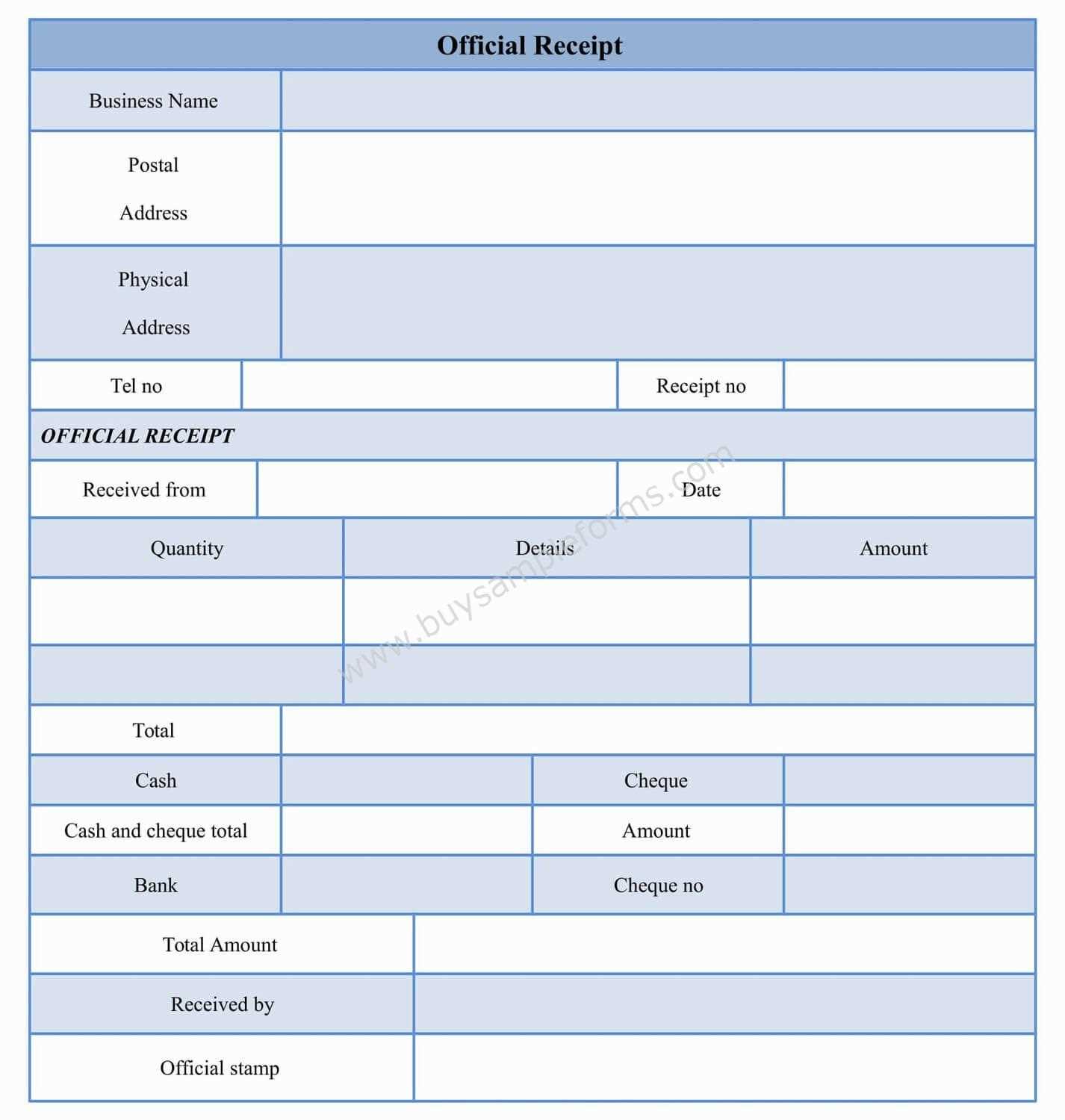

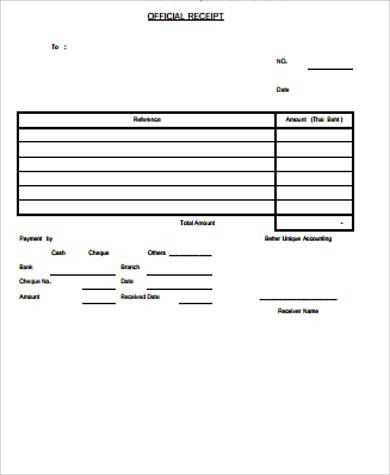

To create an official receipt template in Word for use in the Philippines, start by using a standard layout with clear sections. Include a header with your business name, contact information, and tax identification number (TIN). This ensures transparency and legality. Below the header, add a space for the receipt number, transaction date, and details of the goods or services provided, including prices and quantities.

Ensure that the footer contains your business address, phone number, and email. This helps your customers contact you easily. Always make sure to include the phrase “Official Receipt” at the top to distinguish it from other types of receipts. Include your signature or authorized representative’s name for authenticity.

To comply with tax regulations, it’s important to follow the format set by the Bureau of Internal Revenue (BIR). This includes using sequential numbering for receipts and keeping a copy for your records. Many businesses prefer using Word templates because they are customizable and easy to update when needed. Just make sure to save and back up your templates to avoid losing important documents.

- Official Receipt Template in Word for the Philippines

To create an official receipt template in Word for the Philippines, start by ensuring that the essential fields are included. Here’s how to structure your document:

- Receipt Header: This should include the name of your business, address, contact number, and email. If applicable, include your business registration number.

- Date of Transaction: Clearly state the date when the payment was made. This is important for record-keeping and tax purposes.

- Receipt Number: Generate a unique identifier for each receipt issued. This helps maintain accurate financial records.

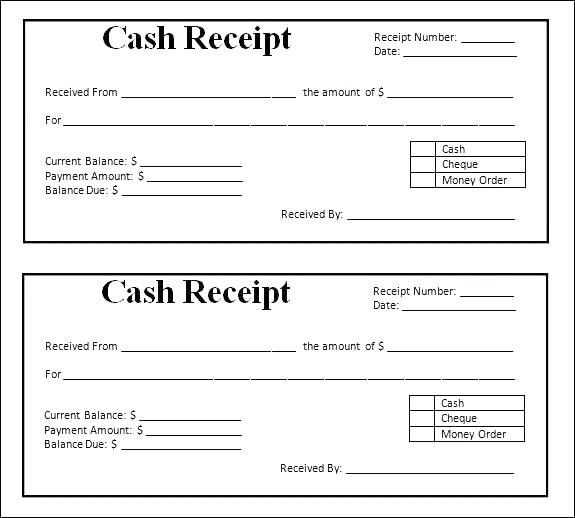

- Payment Details: Include the amount paid, the payment method (e.g., cash, check, bank transfer), and any other relevant transaction information.

- Seller’s Details: Add the name and contact information of the seller or the business providing the service or product.

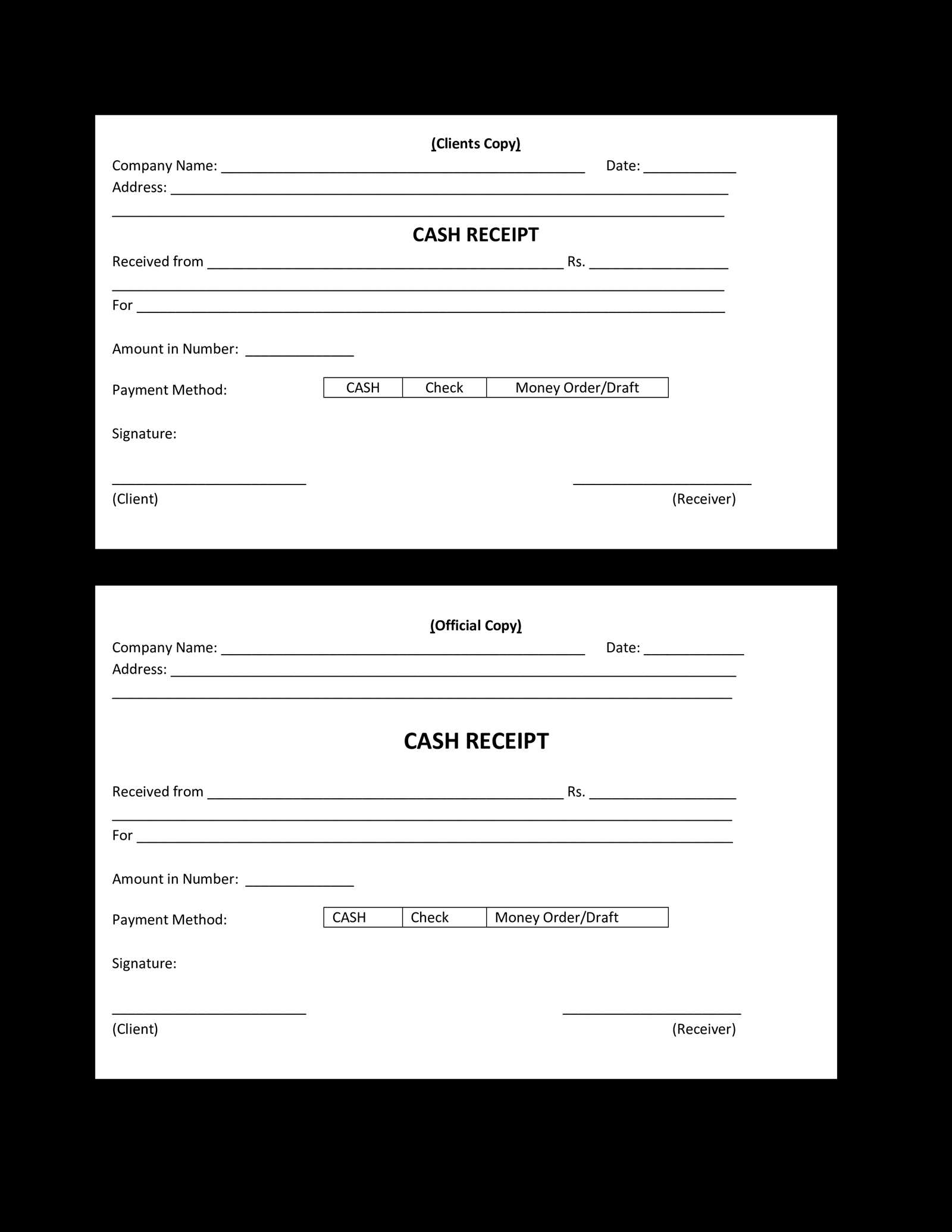

- Signature Line: A space for the seller’s signature to verify the transaction.

- Notes: Include any necessary notes or terms related to the transaction, such as refund policies or warranties.

Ensure the font is legible, and the layout is organized to make the receipt easy to read. You can customize the template with your business’s logo for a professional touch. Once completed, save the template and adjust it for future use.

Begin by opening Microsoft Word and creating a new document. Set the page size to the standard A4 format to match typical receipt dimensions. Use the “Insert” tab to add a header that includes your business name and contact information. This should be bold and easy to read for clarity.

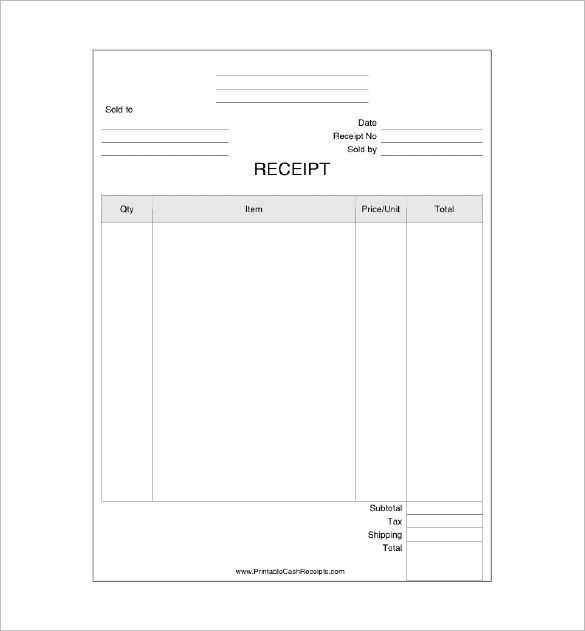

Next, insert the receipt number, date, and a unique identification code, ensuring that these details are placed prominently beneath the header. Consider using a table to structure this information neatly. The table should have separate rows for each piece of information, such as the recipient’s name, payment method, and itemized list of services or goods provided.

For the itemized list, use a table with columns for descriptions, quantities, unit prices, and total amounts. This helps to ensure that each transaction is clearly documented. Add a subtotal row at the bottom of the list and include a row for taxes or discounts, as applicable.

Finally, include a footer with payment terms, your company’s tax identification number, and any other relevant notes such as return policies. Ensure that the footer is aligned consistently with the document’s content. Once everything is in place, save the document as a template for future use, and customize it as needed for each transaction.

Ensure your official receipt includes the following key elements for clarity and legal compliance:

Receipt Number: This unique number identifies the transaction, making it traceable for future reference. It should be clearly visible at the top of the receipt.

Issuer’s Information: Include the name, address, and contact details of the business or individual issuing the receipt. This provides transparency and accountability.

Transaction Date: The date of the transaction should be displayed prominently. This helps track the timing of payments or services rendered.

Itemized List of Products/Services: Include a detailed list of items or services purchased, along with their quantities and prices. This ensures the customer knows exactly what they paid for.

Total Amount Paid: The total amount should be clear and precise, indicating any applicable taxes or discounts applied to the purchase.

Mode of Payment: Specify whether the payment was made by cash, credit card, or other methods. This confirms the transaction’s method.

Signature or Authorization: A signature from the issuer or authorized representative adds authenticity to the document and finalizes the transaction.

To ensure your receipt template complies with Philippine regulations, start by incorporating the necessary details such as the business name, address, contact information, and tax identification number (TIN). These elements are required by the Bureau of Internal Revenue (BIR) for official documentation.

Adjust the layout to accommodate a clear breakdown of products or services, including the quantity, description, price per item, and total amount. Make sure to include the proper VAT details if applicable, as the Philippines follows a VAT system that needs to be reflected in the receipt.

Add the BIR-approved receipt serial number and a space for the payment method (cash, credit, etc.) to enhance transaction transparency. This can help avoid discrepancies during audits.

Lastly, ensure the date and time of the transaction are prominently displayed, as these details are critical for both the business and customer records. You may also want to use the official BIR logo for added authenticity, depending on your business’s requirements.

In the Philippines, businesses must ensure that official receipts meet legal requirements to avoid penalties. These receipts must include the business’s name, address, tax identification number (TIN), and the total amount received for goods or services rendered. They should be issued for every transaction, unless exempted by law.

For a receipt to be valid, it must clearly show the date of transaction, the items or services sold, and the amount paid. This is crucial for tax compliance, as the Bureau of Internal Revenue (BIR) requires businesses to submit accurate and timely tax returns based on sales documented by official receipts.

Failure to issue official receipts or the issuance of incomplete receipts can lead to penalties, including fines or suspension of business operations. Businesses must also ensure that their receipt booklets are registered with the BIR to guarantee legitimacy. It’s important to note that each receipt should be printed on official receipt paper, and the format must follow the BIR-prescribed guidelines.

Moreover, businesses must issue receipts for every sale, even for small transactions, unless an exemption is granted by the BIR. Non-compliance with these regulations could lead to a violation of the National Internal Revenue Code.

Use clear headings for easy identification of key details such as “Receipt” or “Invoice” at the top. Choose a bold and larger font for these headings to make them stand out.

Font and Layout

Opt for simple, readable fonts like Arial or Times New Roman. Keep font size between 10 and 12 points for the main text, and slightly larger for headings. Maintain a consistent style throughout for a clean, professional look.

Alignment and Spacing

Align text and numbers properly. Use left alignment for text and right alignment for amounts to ensure clarity. Leave enough space between sections for easy reading, and use a table format for better organization of items, prices, and totals.

First, save your official receipt template in a convenient location on your computer. Use file formats like .docx or .pdf for easy access and sharing. These formats ensure compatibility across various devices and platforms.

To save your document in Word, click on “File” then “Save As” and choose your preferred location. For PDF format, select “PDF” from the “Save as type” dropdown menu before clicking “Save”.

To share the template, simply attach the saved file to an email or upload it to cloud storage services like Google Drive or Dropbox. Share the link with the recipient for quick access.

| File Format | How to Save | Sharing Method |

|---|---|---|

| Word (.docx) | Click “Save As” and select Word format | Email attachment or cloud upload |

| PDF (.pdf) | Select “PDF” from Save as type | Cloud link sharing or direct email |

Sharing via cloud platforms allows recipients to view or download the template directly. This option is particularly useful for businesses that need to send receipts regularly.

For creating an official receipt template in Word for the Philippines, follow these steps to ensure all necessary components are included:

- Header Information: Include the title “Official Receipt” at the top of the document.

- Business Information: Provide the full name, business address, contact details, and the business’s tax identification number (TIN).

- Receipt Number: Assign a unique sequential number for each receipt to maintain proper records.

- Date of Transaction: Clearly indicate the date the transaction occurred.

- Details of Items/Services: List the items or services provided along with their corresponding amounts.

- Total Amount Paid: Clearly state the total amount received, including taxes if applicable.

- Mode of Payment: Specify whether the payment was made via cash, check, or any other method.

- Authorized Signature: Include a space for the signature of the person authorized to issue the receipt.

Make sure to use a professional font and clear formatting to ensure readability. This template serves as a reliable document for both businesses and customers, confirming that a transaction took place.