If you’re looking to streamline payroll management, using a payroll receipt template in Word can be a quick and efficient solution. A well-structured template helps both employers and employees keep track of earnings, deductions, and net pay, reducing potential errors and improving clarity.

By choosing a Word template, you can easily customize the layout to suit your company’s needs. The built-in formatting options allow you to add fields such as employee name, hours worked, overtime pay, and tax withholdings without needing advanced technical skills. These templates can be reused for each payroll cycle, saving time and effort.

Furthermore, a payroll receipt template in Word is compatible with most office software, making it simple to share or print. It offers the flexibility of both digital and physical copies, which can be important for different record-keeping practices.

Here are the corrected lines with reduced repetition:

To simplify your payroll receipt template, focus on streamlining the information without losing any key details. Here are the improved suggestions:

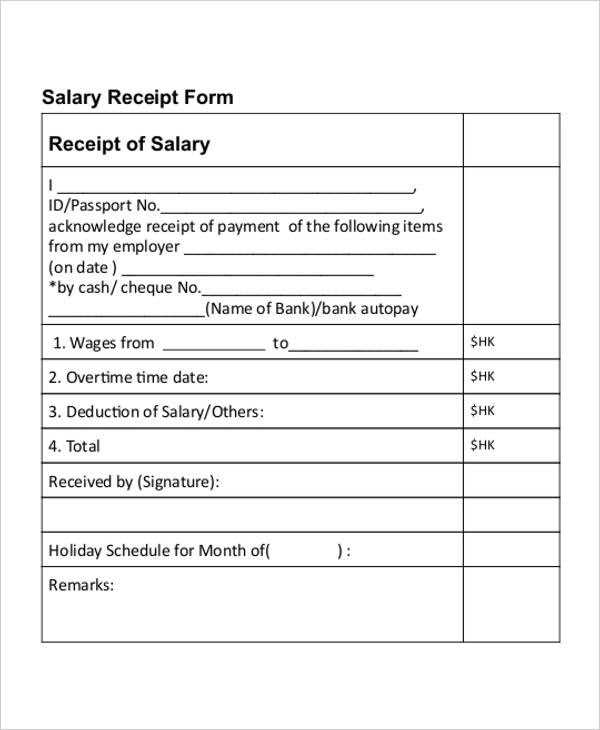

1. Simplified Salary Breakdown

- Gross Salary: $4,000.00

- Deductions: $500.00

- Net Salary: $3,500.00

2. Clarified Payment Details

- Payment Date: 11th February 2025

- Bank Account: 123-456789

By structuring the receipt this way, you keep it clear and concise while ensuring all necessary details are included without redundancy. Avoiding repetitive wording helps maintain professionalism and readability.

- Payroll Receipt Template Word: A Practical Guide

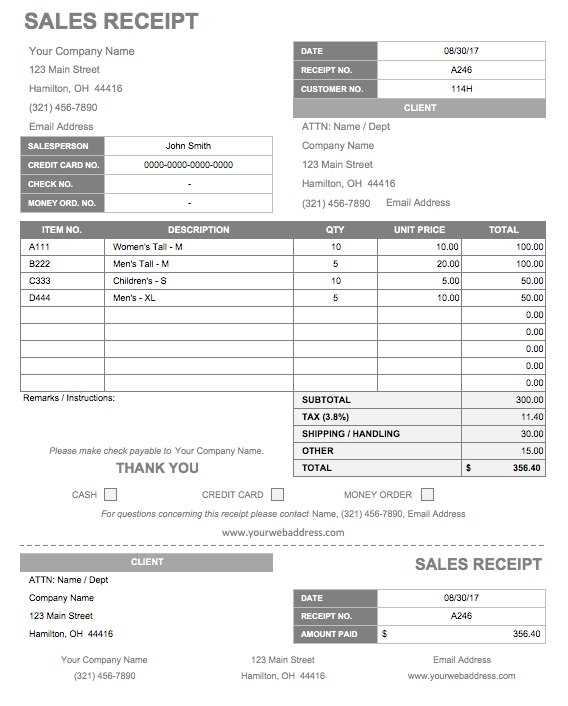

Using a Payroll Receipt Template in Word helps streamline the payment process for both employers and employees. Start with a template that includes all required details such as the employee’s name, pay period, earnings, deductions, and net pay. Ensure the layout is clean and easy to read, with separate sections for earnings, deductions, and additional payments like bonuses or overtime.

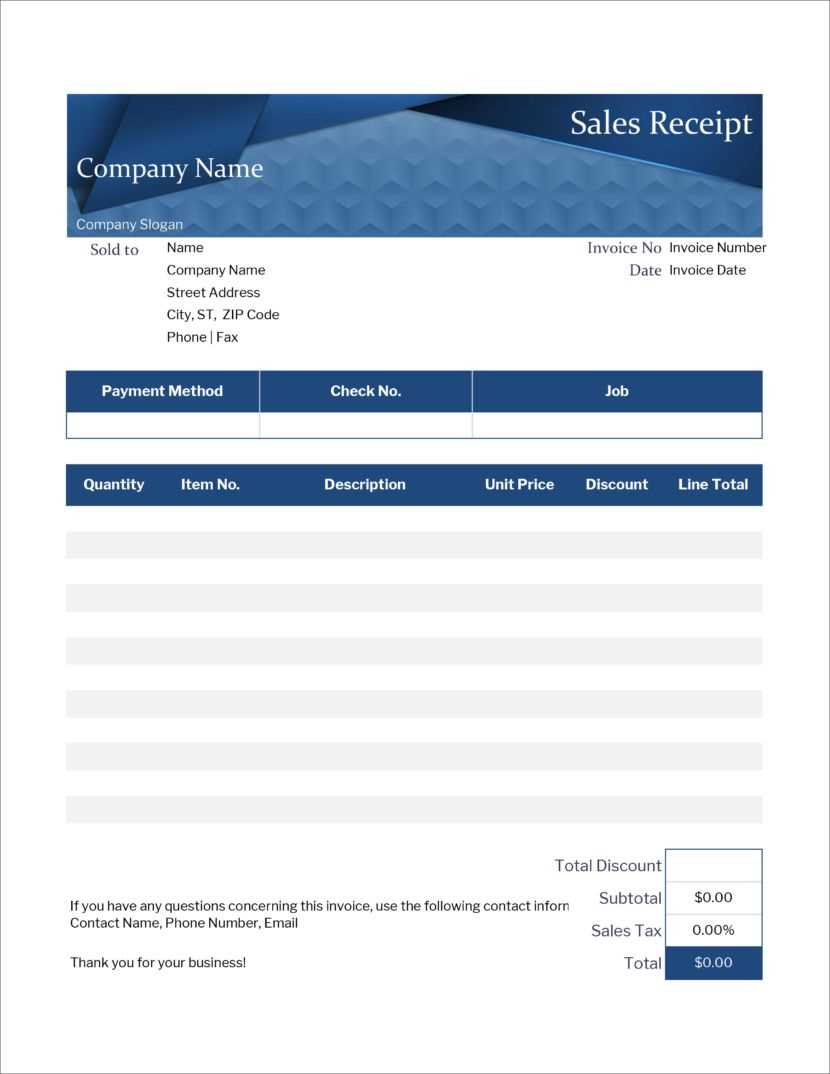

Customize the template with your company’s branding, such as the logo and contact information, making it professional yet simple. Use clear headings for each section, like “Gross Pay,” “Taxes,” and “Net Pay,” to enhance readability. Be sure to include a section for year-to-date totals, which will be useful during tax season.

When inputting earnings, include both regular pay and any additional compensation, listing hourly rates or salaried amounts, and hours worked if applicable. Deductible items, including taxes, insurance, or retirement contributions, should be itemized clearly. This helps employees track their earnings and withholdings in one document.

After completing the payroll receipt, save the file in a secure location and send it to employees. You can also use it as a template for future pay periods, ensuring consistency across all payroll receipts. Regular updates are necessary if there are changes to pay rates, deductions, or benefits. This approach makes payroll processing smooth and ensures transparency for all parties involved.

Open a blank document in Word and begin by inserting a table. The table layout should include sections for the employee’s name, job title, pay period, gross pay, deductions, and net pay. Adjust the column widths to ensure each section is clearly visible. Next, customize the font style and size for a professional look, using bold or italics for headings. Ensure the text aligns properly, especially the financial details. Consider adding company logos, a signature line, or footer with legal disclaimers, if necessary.

Step-by-Step Customization Tips

Insert borders to define each section of the receipt. Use shading or background colors to highlight key information like the net pay. If the payroll receipt needs to include taxes or deductions, create additional rows within the table for these items. You can add formulas for automatic calculations, such as total pay or tax deductions. Customize the header by including the company name and address for a polished appearance.

Final Touches

Once the template looks good, save it as a reusable template. Use Word’s “Save As” feature to store the file in a folder for future use. This allows you to quickly generate receipts for new employees or different pay periods. If you plan to send receipts electronically, consider saving the file as a PDF for better security and compatibility.

A well-organized payroll receipt includes the following details to ensure clarity and transparency:

| Element | Description |

|---|---|

| Employee Information | List the employee’s full name, job title, and unique employee ID number. |

| Pay Period | Specify the start and end date of the pay period, along with the date the payment is issued. |

| Gross Income | Indicate the total earnings before any deductions, including hourly wages or salary, bonuses, and overtime pay. |

| Deductions | Detail all deductions, such as tax withholdings, benefits contributions, retirement plan contributions, or any other withheld amounts. |

| Net Pay | Show the final amount paid to the employee after deductions have been subtracted from the gross income. |

| Employer Contributions | Include any contributions the employer makes toward benefits like health insurance, retirement, or taxes. |

| Year-to-Date (YTD) Totals | Provide a running total of earnings, deductions, and contributions for the year to date, helping employees track their finances. |

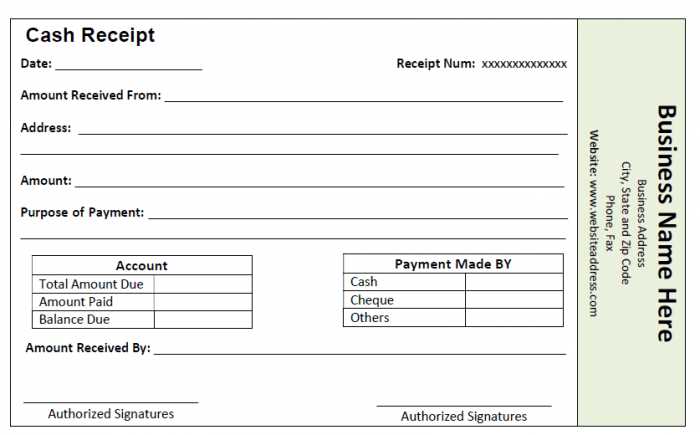

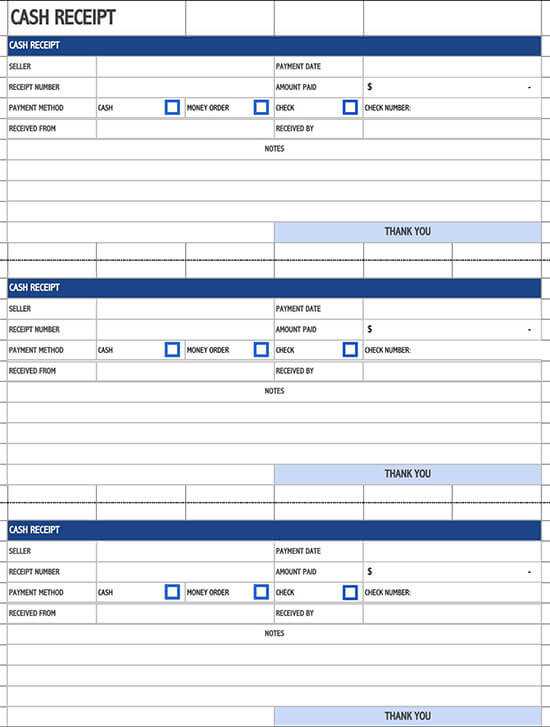

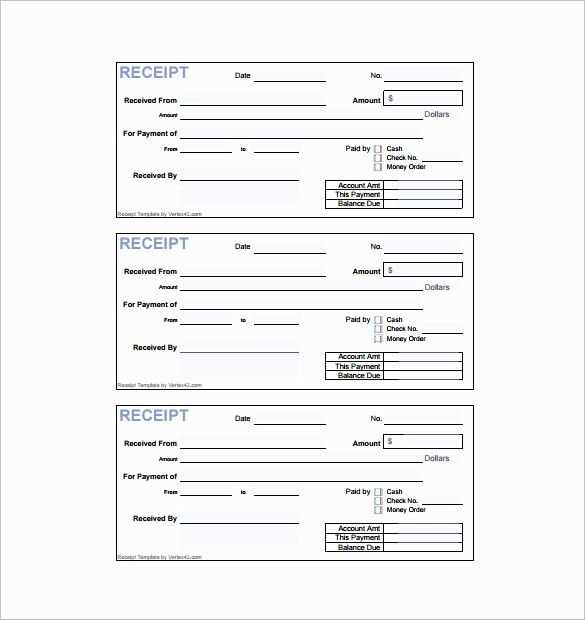

| Payment Method | State how the employee was paid (e.g., direct deposit, check, cash). |

| Employer Information | Include the employer’s name, address, and contact details for reference. |

These elements ensure transparency, helping employees easily understand their compensation details.

To save and share a payroll receipt in Word format, follow these steps:

1. After completing your receipt in Word, click on the “File” tab in the upper left corner.

2. Select “Save As” from the dropdown menu.

3. Choose the location where you want to save the document (e.g., your computer, cloud storage, etc.).

4. In the “Save as type” dropdown menu, select “Word Document (*.docx)” to ensure the file is saved in Word format.

5. Name the file appropriately for easy identification, such as “Payroll_Receipt_February_2025,” and click “Save.”

6. To share the receipt, go back to the “File” tab and select “Share.” You can either send it via email by selecting “Email” or share a link by selecting “OneDrive” if your document is saved on cloud storage.

7. If you prefer, you can also attach the saved Word document to an email manually by selecting the “Attach File” option in your email client and browsing to the location of your saved file.

Choose a payroll receipt template that suits your business needs and employee preferences. Look for a clean design that clearly outlines earnings and deductions. Ensure it includes the necessary components like employee name, pay period, gross pay, taxes, and net pay.

- Ensure all payment details are visible, such as base pay, overtime, bonuses, and other allowances.

- Incorporate deductions like tax, insurance, retirement contributions, and any other applicable fees.

- Include clear contact details for HR or payroll inquiries for easy reference.

- Use proper formatting with distinct sections for readability, avoiding clutter.

- Confirm that the template can be easily customized to fit specific business needs, including adding custom fields for additional information.

- Ensure compatibility with payroll software to avoid errors in payroll processing.

- Provide space for a breakdown of any relevant tax information to help employees understand their withholdings.

- Test the template for various scenarios to ensure all fields adjust correctly for different pay amounts.