For a clear and professional receipt, focus on providing all the necessary details while keeping the language straightforward. Start with the date of the transaction and include the names of both parties involved–vendor and customer. Be sure to list the products or services provided along with their corresponding prices, taxes, and any discounts applied.

Make sure to include the total amount due at the bottom, as well as the payment method used, whether it’s cash, credit card, or another form. If applicable, add any transaction or reference numbers for easy tracking. Avoid overly complex phrasing–simplicity is key to a useful receipt.

Example: “Paid $50.00 for 2 pairs of shoes on January 5th, 2025, using a Visa card ending in 1234. Transaction ID: 987654321.” This type of clear, concise wording eliminates confusion and ensures both parties have the necessary information. Always double-check that the amounts and dates are accurate before issuing a receipt.

Here is the revised version:

To create a clear and professional receipt, ensure the wording is concise and provides all necessary information. Follow these key guidelines for effective communication:

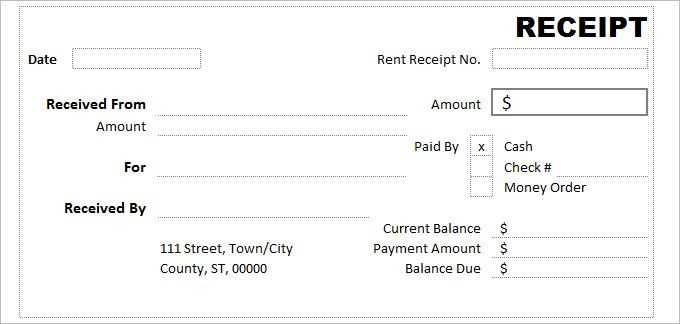

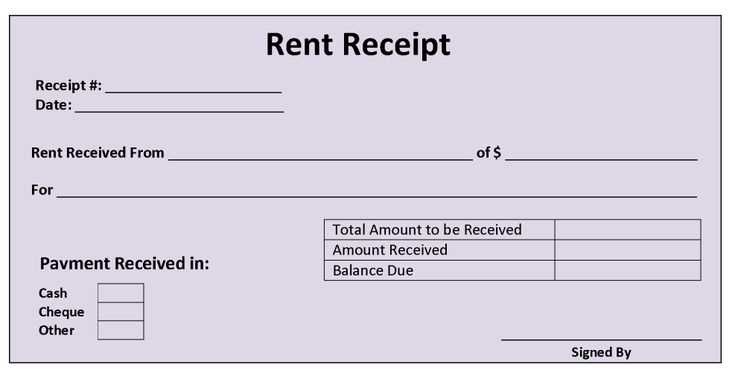

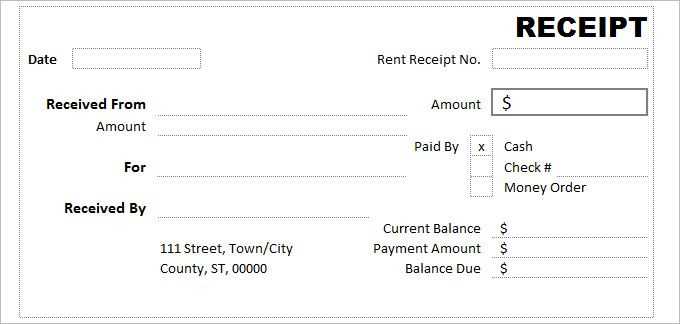

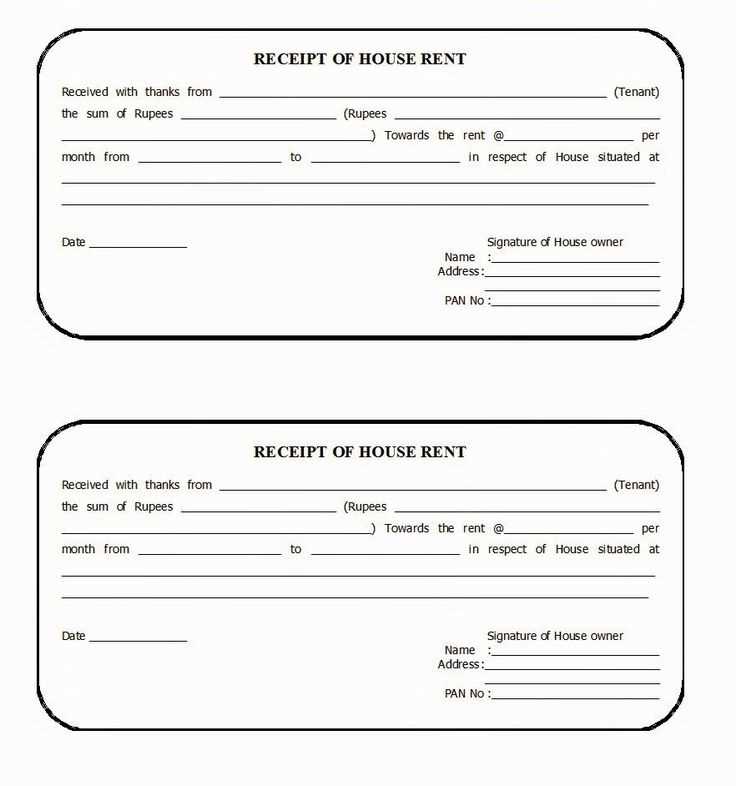

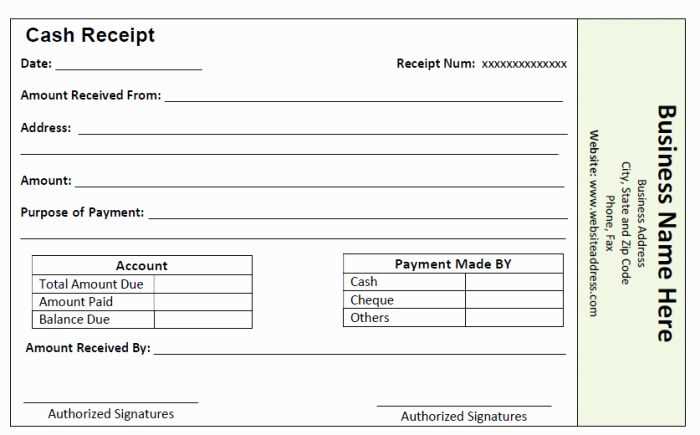

| Header: | Include your company name, logo, and contact details at the top for easy reference. |

| Transaction Details: | List the date of purchase, transaction number, and itemized description of goods or services provided. |

| Total Amount: | Clearly state the total amount, including taxes and any discounts applied. |

| Payment Method: | Indicate whether payment was made by cash, credit card, or other methods. |

| Thank You Note: | Express gratitude for the customer’s business. A simple “Thank you for your purchase!” can suffice. |

By following this format, you ensure the receipt is both clear and informative, allowing customers to easily reference their transactions when needed.

- Receipt Wording Template

Use clear and direct wording for a receipt to ensure that all necessary details are included and easily understood by both the recipient and the issuer. A well-structured receipt wording template should cover the transaction’s key points, such as the date, amount, payment method, and a description of goods or services provided.

Basic Elements of Receipt Wording

Each receipt should contain these elements:

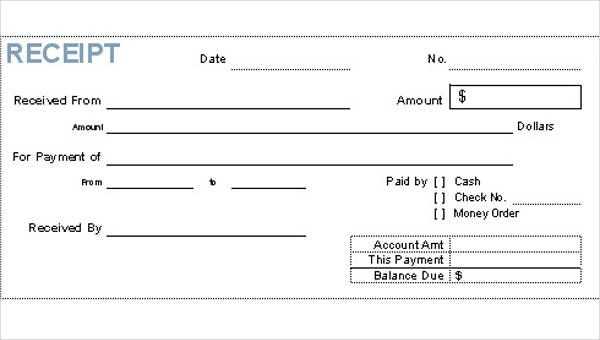

- Receipt title: Label it clearly as “Receipt” to avoid any confusion.

- Date: Include the date of the transaction for record-keeping.

- Amount: Specify the total amount paid in both numbers and words.

- Payment method: Indicate whether the payment was made via cash, credit card, or another method.

- Description: Provide a brief description of what was purchased or the service rendered.

- Issuer’s details: Include the name and contact information of the business or individual issuing the receipt.

Example of a Receipt Wording Template

Here is a simple receipt wording template you can customize:

Receipt Date: [Insert Date] Received from [Customer Name] Amount: [Total Amount] ([Total Amount in Words]) Payment Method: [Cash/Credit Card/etc.] Description of goods/services: - [Item 1] - [Item 2] - [Item 3] Issued by: [Your Business Name] Contact: [Your Contact Information]

Customize this template as needed, but make sure to always include these key points for clarity and accuracy.

Be clear and concise when describing items on receipts. Focus on key details that allow the customer to identify the product or service. Avoid long or vague descriptions, as they can create confusion.

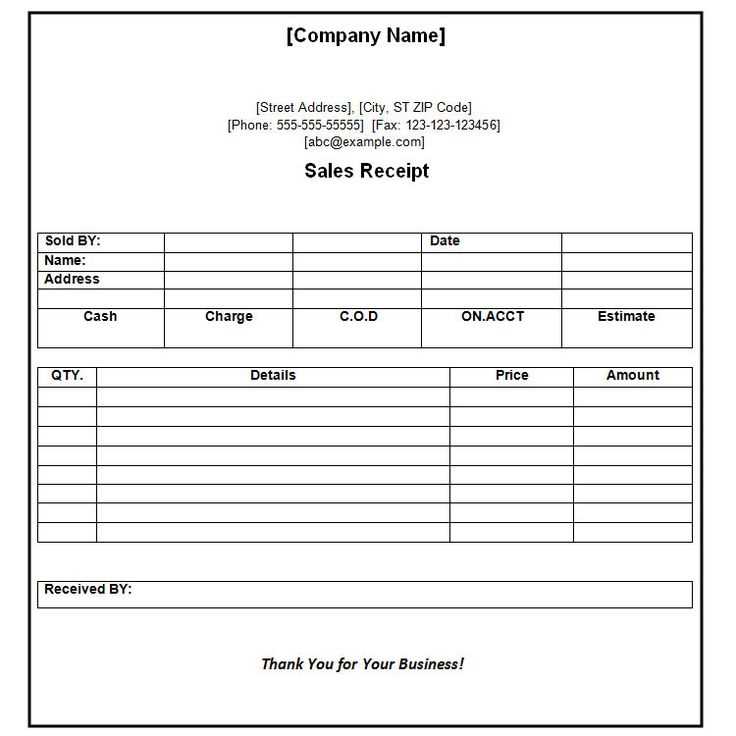

Use Specific Names and Terms

Start with the exact name of the product or service, avoiding abbreviations unless they are commonly known. For example, instead of “Phone,” write “Apple iPhone 13 128GB.” If applicable, include model numbers, sizes, colors, and other relevant attributes that help differentiate items.

Include Quantity and Price Information

Clearly state the quantity of each item purchased, along with its individual price. For bundled items or services, specify what is included in the bundle. For example, “2 x Coffee Cups – $5.00 each” or “Service Package – Includes maintenance and support, $100.” If discounts apply, make them visible in the description.

If possible, use consistent formatting throughout the receipt to create a clean and easy-to-read layout. This approach not only improves clarity but also helps build trust with your customers.

Including Payment Methods: Key Information for Receipts

Clearly stating the payment method on receipts helps avoid confusion and ensures transparency. This is particularly important for businesses dealing with multiple forms of payment. Be specific about whether the payment was made through cash, credit card, debit card, or digital wallets like PayPal or Apple Pay. If a card was used, include the last four digits of the card number for reference. This can help resolve any disputes or inquiries regarding the payment.

Cash Payments

If the payment was made in cash, simply noting “Cash” along with the amount received is sufficient. Ensure the amount matches the total due to avoid misunderstandings. You don’t need to include further details unless necessary, such as if change was given, which should also be reflected.

Digital Payments

For payments via digital methods, including the type of transaction (e.g., PayPal, Apple Pay) and transaction ID can be useful. This allows customers to cross-reference the payment with their account history. For credit and debit card transactions, including the card’s last four digits will add clarity. This minimizes the chance of disputes, making it easier to track down the exact payment if needed.

Writing the Date and Time: Best Practices for Clarity

To ensure clarity, always write the date and time in a consistent, easy-to-read format. Use the month-day-year format for dates (e.g., February 6, 2025), as it is widely understood and reduces confusion. Avoid abbreviating months or using numeric formats like “02/06/25,” as these can cause misunderstandings, especially internationally.

Consistency is Key

Consistency in your date and time format prevents errors and confusion. Stick to one style throughout the receipt. If you choose to display the time, include the AM/PM designation, or use the 24-hour format to avoid ambiguity. For example, use “2:30 PM” or “14:30” depending on your audience.

Consider Time Zones

If the transaction spans multiple time zones, include the time zone abbreviation (e.g., EST, PST, GMT). This adds transparency and prevents any time-related confusion for both the issuer and the recipient.

By following these simple practices, you’ll enhance clarity and avoid any potential misinterpretations of time and date on your receipts.

Adding Tax Details and Discounts to Receipt Text

Include clear tax and discount information on receipts to ensure transparency for customers. This helps them understand how the total amount is calculated and any savings they’ve received. Here’s how to incorporate this data effectively:

- Tax Breakdown: Add a specific line item showing the tax amount applied. For example: “Sales Tax: $X.XX”. Ensure the tax rate used is reflected in the calculation.

- Discounts: Include a line for any discounts applied, showing the percentage or amount. For instance: “Discount Applied: $X.XX” or “10% Off: $X.XX”.

- Total After Tax and Discount: Display the final amount after tax and discount. This should be bold or in a larger font to stand out. For example: “Total: $X.XX (after tax & discount).”

- Itemized Costs: List individual item prices before tax and discounts to offer clarity on how the final total is reached.

- Tax Rates: If necessary, include the tax rate used in your calculation for full transparency. For example: “Tax Rate: 7%”.

Keep it simple but precise. Your customers will appreciate the clarity, making the receipt a helpful reference in case of future queries.

Clearly state refund and return policies directly on receipts. Specify the time frame within which returns are accepted and any conditions, such as the need for the original packaging or a receipt. Mention whether refunds are issued to the original payment method or as store credit. If there are restocking fees or exceptions (like clearance items), include those details to avoid confusion.

Using clear language helps customers understand their rights and improves their shopping experience. Including a contact number or email address for further inquiries about returns or refunds can also be helpful.

Position the refund and return policy section towards the bottom of the receipt for easy reference, ensuring it’s concise and easy to read. This not only provides customers with relevant information but also reinforces your store’s transparency and customer service standards.

Receipt statements must meet specific legal requirements to protect both businesses and consumers. Ensuring clarity and accuracy in the information presented is vital for compliance with local laws and regulations. Below are key legal points to consider when drafting receipt statements.

Required Information

- Business Name and Contact: Include the full legal name of the business and contact details for ease of communication in case of disputes.

- Date and Time of Transaction: Clearly state the date and time to establish the timeline of the transaction.

- Itemized List of Goods/Services: Include specific descriptions and the quantities of items or services purchased to avoid confusion.

- Total Amount Paid: Display the total sum, including taxes and any additional fees, to ensure transparency in pricing.

Consumer Protection Laws

- Refund and Return Policies: Clearly state the terms under which products can be returned or refunded, as some jurisdictions require such disclosure on receipts.

- Data Privacy: Be cautious about collecting personal information on receipts. Laws such as the GDPR or CCPA may require consent or limit how personal data is used.

- Consumer Rights: Include any disclaimers or warranties that apply, ensuring they align with consumer protection laws in your area.

Failure to include these elements may lead to legal disputes, fines, or a loss of consumer trust. Always review local laws to ensure your receipt statements comply with all relevant regulations.

Use clear and concise wording in receipts to avoid confusion. A typical receipt should include details such as the date of purchase, items purchased, price, payment method, and any applicable taxes or discounts. Ensure the total is clearly displayed at the bottom for quick reference.

Start with a straightforward header, like “Receipt” or “Transaction Confirmation.” After the header, list the itemized purchases with descriptions and quantities. Make sure the prices are accurate and formatted consistently, and always include a subtotal before taxes and discounts.

Include the payment method, whether it’s cash, card, or digital wallet, and show the amount paid. If a discount was applied, show it clearly under the subtotal and before the final total. Taxes should be listed separately, and if there are multiple tax rates, break them down by category.

For receipts with a return policy or any special instructions, place that information in a section towards the bottom. This allows customers to easily find it without cluttering the main content of the receipt.

Finally, include your business contact details, including an email address or phone number, for any inquiries or issues. This adds a professional touch and gives customers a clear path for follow-up if necessary.