For landlords and tenants in India, a rent receipt is a key document that verifies the payment of rent. A rent receipt template in Word format can simplify the process, offering a professional, clear structure for both parties. Using a template ensures all necessary details are included and reduces the risk of errors.

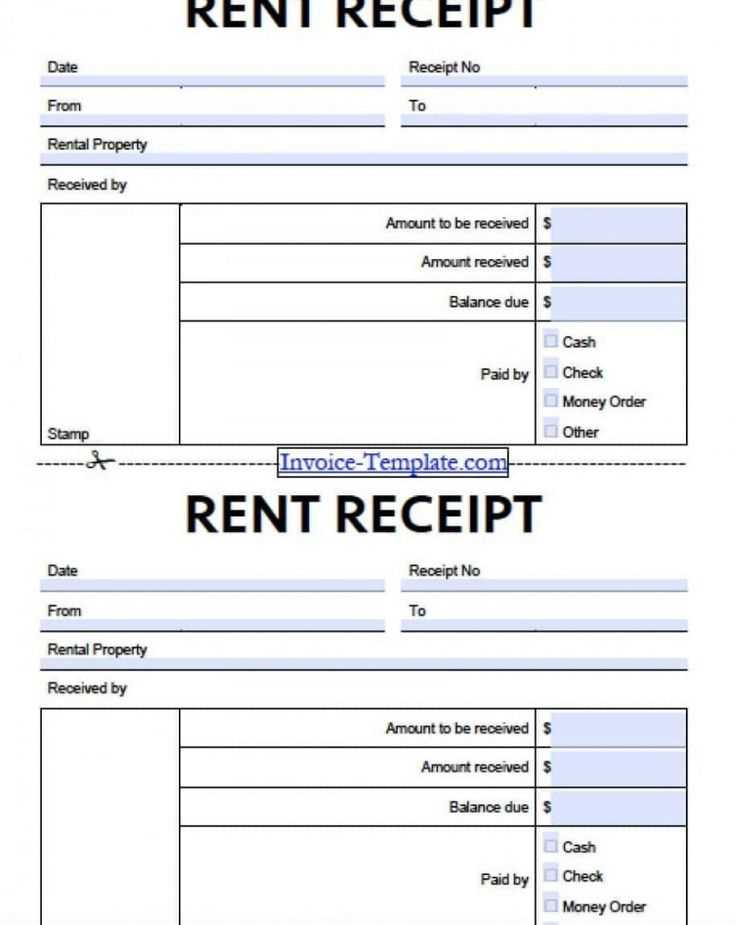

Choose a template that includes fields for the tenant’s name, property address, rent amount, payment date, and the period for which the rent is being paid. This structure ensures that the receipt serves both as proof of payment and as a reference for future transactions. Ensure the document is signed by both the landlord and the tenant for validity.

To create a rent receipt in Word, you can either download a template online or customize one according to your specific requirements. When filling in the information, make sure that the payment method is clearly noted, whether it is by cheque, cash, or bank transfer. This helps avoid misunderstandings and provides clarity for both parties.

Here’s the corrected version:

To create a rent receipt in Word format that meets the standards in India, make sure the template includes all necessary details for clarity and legal purposes.

Key Details to Include

Each receipt should have the following:

- Landlord’s Name and Address – Make sure these details are clearly stated to avoid any confusion.

- Tenant’s Name and Address – Specify the tenant’s name and the property they are renting.

- Rent Amount – Mention the amount of rent paid along with the currency (INR). Include the rental period (e.g., monthly or annually).

- Date of Payment – Clearly state the payment date to confirm the exact transaction date.

- Payment Mode – Specify the mode of payment, whether it’s through cheque, cash, or bank transfer.

- Property Address – Include the full address of the rented property.

Additional Considerations

For added clarity and authenticity, consider adding a section for signature at the bottom of the receipt. This serves as proof of the transaction and can be signed by either the landlord or the tenant. Make sure to format the document neatly, avoiding unnecessary details that could clutter the receipt.

- Rent Receipt Template for Word in India

A rent receipt template for Word in India should include key details for both the landlord and tenant. This ensures transparency and avoids potential disputes. Follow these steps to create a clear and professional rent receipt.

Key Information to Include

- Landlord’s Details: Name, address, and contact information.

- Tenant’s Details: Name, address, and contact information.

- Property Details: Complete address of the rented property.

- Receipt Number: A unique reference number for each receipt.

- Rent Amount: The agreed-upon rent for the period.

- Payment Date: The exact date rent is received.

- Payment Mode: Specify whether the rent was paid via cheque, bank transfer, or cash.

- Signature: Both landlord and tenant should sign the receipt to confirm the transaction.

Creating the Template in Word

- Open Microsoft Word and start with a blank document.

- Use a table to organize information like tenant details, payment amount, and date.

- Include space for both parties’ signatures at the bottom of the receipt.

- Ensure proper formatting with clear headings and aligned text for a professional look.

- Save the template for future use, making it easy to update details when required.

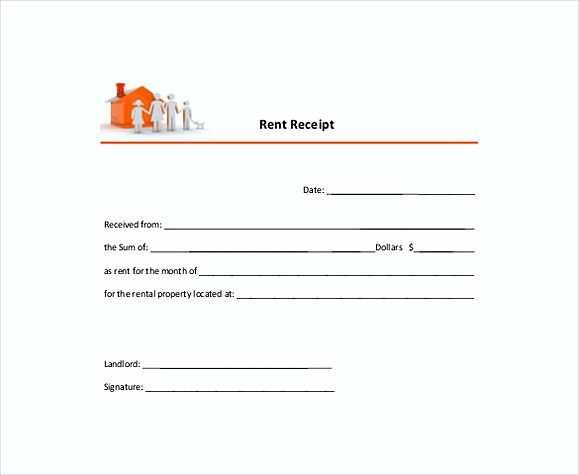

Creating a rent receipt template in Word is straightforward and can save time for both landlords and tenants. Follow these steps to design a functional template:

- Open Microsoft Word: Start with a blank document in Word.

- Set Up Page Layout: Adjust the page size, margins, and orientation. For most receipts, A4 size with standard margins works well.

- Insert Title: Place a title at the top of the document such as “Rent Receipt” or “Rental Payment Receipt”. Make it bold and centered for visibility.

- Add Date: Include a line for the date of payment. Use a simple format like “Date of Payment: [DD/MM/YYYY]”.

- Tenant and Landlord Information: Create sections to input tenant details (name, address, contact info) and landlord details (name, contact details).

- Payment Details: Include a section for rent amount paid, the rental period, and payment method (bank transfer, cash, etc.). This is crucial for clarity.

- Receipt Number: Numbering each receipt helps track transactions. Add a placeholder for the receipt number, like “Receipt No: [XXX]”.

- Signature Line: Leave space for both the tenant and landlord signatures. This confirms the transaction was made.

- Save the Template: Once the layout is ready, save the document as a template in Word. You can then reuse it for future rent receipts.

This template can be customized with additional details like late fees, maintenance charges, or terms of payment based on the rental agreement.

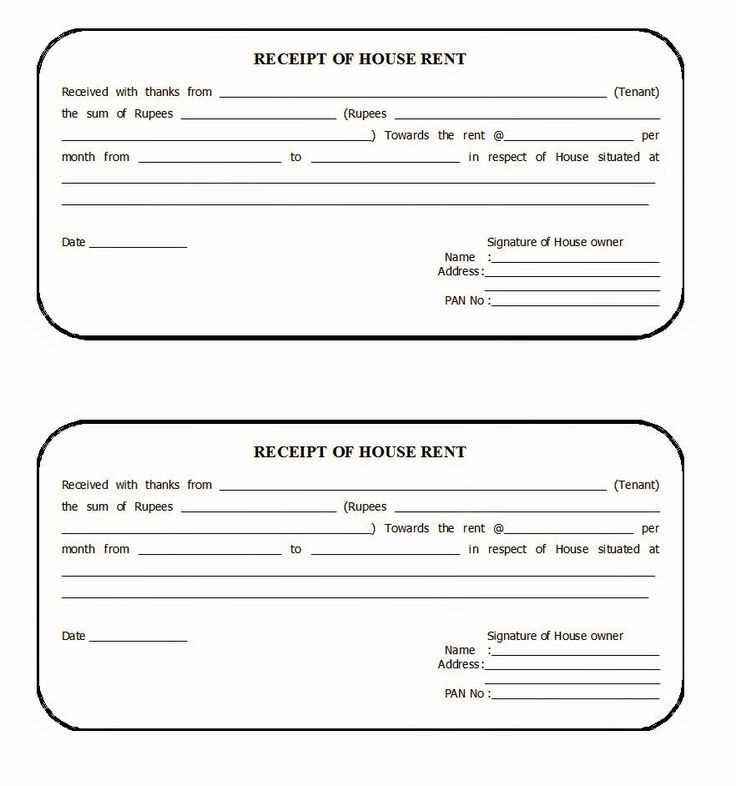

Begin by including the full name and address of the landlord. This ensures that the document is properly attributed and can be referenced later if needed. Next, include the tenant’s name and address. This allows both parties to confirm that the receipt pertains to the correct rental agreement.

Specify the date of payment, ensuring it aligns with the rent period, whether monthly or quarterly. Indicate the exact amount paid by the tenant, and clearly state the currency, typically in INR. This helps avoid confusion about the sum and makes the document legally sound.

Include a reference to the rental agreement or lease, mentioning the period for which the payment is being made (e.g., “Rent paid for the month of February 2025”). This ties the payment to the specific contract.

Clearly state the mode of payment (e.g., cash, bank transfer, cheque). This is important for both tax records and proof of transaction. If applicable, include the cheque number or transaction ID for easier tracking of payments.

If the rent includes additional charges such as maintenance or service fees, make sure to list them separately. Detail these charges to avoid any ambiguity about what was covered in the payment.

Finally, both parties should sign the rent receipt. The landlord’s signature acknowledges the receipt of payment, and the tenant’s signature confirms the transaction has been recorded correctly.

To customize a rent receipt template for different rent amounts, adjust the numerical values in key fields. Ensure the total amount paid is correctly reflected in both words and figures. This prevents any discrepancies or confusion. When adjusting the amounts, make sure to modify the breakdown section, if applicable, such as rent for the month, security deposit, and other charges like utilities.

1. Setting the Correct Rent Figures

For each new payment, change the “Rent Amount” field to reflect the correct sum. If multiple tenants share a space, break down the total into individual shares. Double-check for accuracy in both the numbers and the written-out form to avoid misunderstandings.

2. Including Additional Charges

If there are additional charges (e.g., maintenance or parking fees), list them clearly below the rent amount. Ensure that each charge is labeled, and adjust the final total accordingly. This ensures the tenant understands what they’re being charged for, and provides transparency.

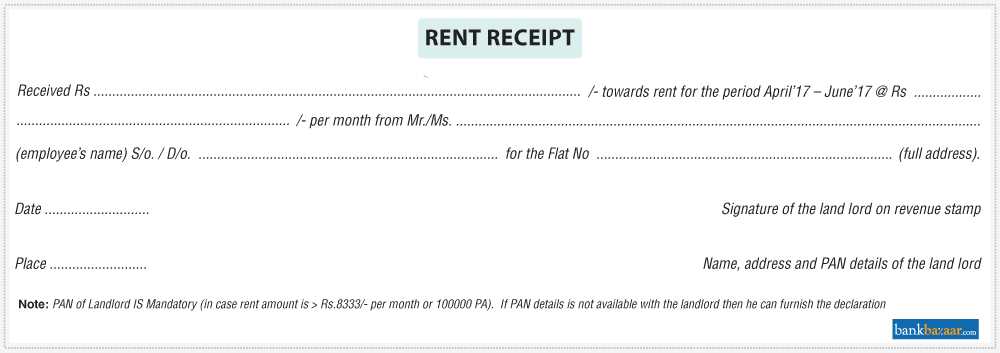

In India, a rent receipt is a vital document for both tenants and landlords. It serves as proof of rent payment, which may be required for tax purposes or for legal purposes in case of disputes. Rent receipts must include the following details: the full name and address of both the landlord and the tenant, the amount of rent paid, the period for which the rent is being paid, the date of payment, and the signature of the landlord. These elements are necessary to make the receipt legally valid.

While a rent receipt is not mandated by law, it is strongly recommended for both parties. For tenants, it ensures they have proof of payments, especially when the lease period is long. For landlords, it helps maintain proper financial records. In case the rent is paid by cheque or online transfer, mentioning the mode of payment can provide additional clarity.

If the rent exceeds ₹3,000 per month, the landlord is required to pay Goods and Services Tax (GST) on the rental income. In such cases, the rent receipt should also include the GST registration number of the landlord along with the applicable GST amount. A rent receipt for amounts below ₹3,000 does not require GST inclusion.

To include GST details in a rent receipt template, first identify the GST applicable to the rent. This is important as the GST on rental income in India varies based on the type of property (residential or commercial) and the service provider’s GST registration status.

Steps to Add GST Information

Follow these steps to ensure accurate GST details are included in your rent receipt:

- GST Registration Number: Include the landlord’s GSTIN (Goods and Services Tax Identification Number) at the top of the receipt. This is mandatory for registered taxpayers.

- GST Rate: Clearly state the GST rate applied to the rent. As of now, GST for residential properties is exempt, while commercial property attracts 18% GST.

- Breakdown of Rent and GST: If GST is applicable, split the rent amount and the GST amount in the receipt for transparency.

Template Example

Here’s an example layout for adding GST to a rent receipt:

| Description | Amount (INR) |

|---|---|

| Rent | ₹20,000 |

| GST @ 18% | ₹3,600 |

| Total Amount Paid | ₹23,600 |

By including GST details in the rent receipt, both landlord and tenant stay compliant with tax regulations while maintaining clarity in financial transactions.

To ensure proper record keeping, save and print rent receipts as soon as transactions are completed. This helps to maintain organized financial documentation and proves payment history for both landlord and tenant. After filling out the rent receipt template, save the file in a widely accepted format like PDF or DOCX. These formats preserve the content layout and can be easily accessed or shared when needed.

Saving Rent Receipts

When saving the rent receipt, ensure the file name includes relevant details such as the tenant’s name, the date of the payment, and the month for which the rent was paid. This makes it easier to locate the receipt later. Use a folder system on your computer or cloud storage to categorize the receipts by year or tenant for quick retrieval.

Printing Rent Receipts

For physical records, print the saved receipt on high-quality paper. Verify that the details such as payment amount, tenant and landlord names, and date are clearly visible. Store printed receipts in a safe place, such as a file cabinet or a document binder, categorized by year or tenant. This provides easy access for future reference and legal or tax purposes.

Incorporating a rental receipt template into your workflow can save time and ensure accuracy. When creating a rent receipt, make sure it includes clear details such as the tenant’s name, landlord’s name, property address, amount paid, payment date, and payment method. These are key elements that provide transparency and record-keeping for both parties.

Key Details to Include in a Rent Receipt

- Tenant’s Full Name

- Landlord’s Full Name

- Property Address

- Amount Paid

- Payment Date

- Payment Method (e.g., bank transfer, cheque, cash)

- Receipt Number (for tracking purposes)

- Signature of the Landlord (if required)

Ensure that the template is easy to fill in and adjust for different rent periods. A simple, well-structured receipt will streamline communication and reduce disputes about payment. Avoid clutter and unnecessary sections that can complicate the process.