Using an official receipt template in Word can save time and streamline your documentation process. It helps create clear and professional receipts for transactions, whether you’re running a business or managing personal finances. Instead of starting from scratch, this template allows you to input details such as payment amount, payer information, and transaction date quickly.

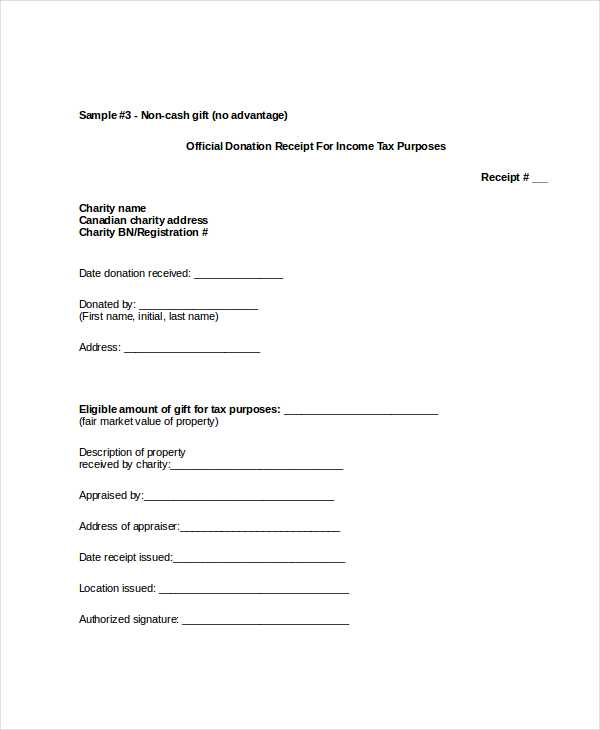

Downloadable templates often come pre-formatted with necessary fields like the name of your business, address, and contact details. These templates are customizable, allowing you to adjust them based on your needs. When using a Word document, you can easily edit the template, add logos, or change font styles to suit your business branding.

By utilizing a Word receipt template, you not only ensure consistency in your receipts but also save valuable time for more important tasks. It’s a simple yet powerful tool for anyone needing to provide receipts professionally and efficiently.

Here’s the corrected version:

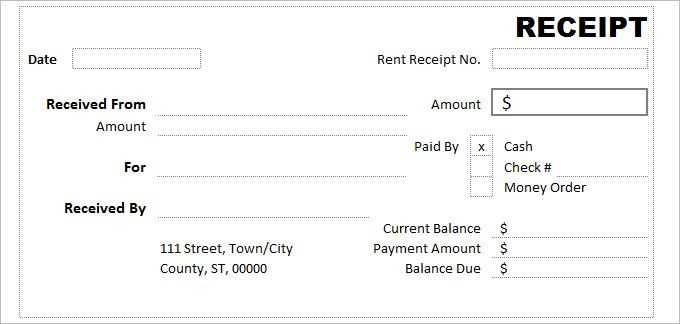

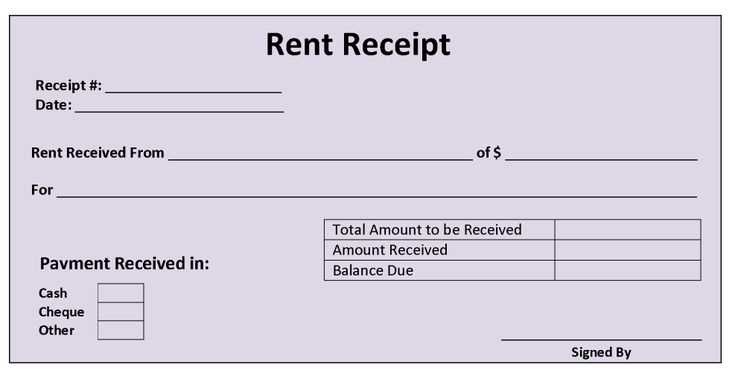

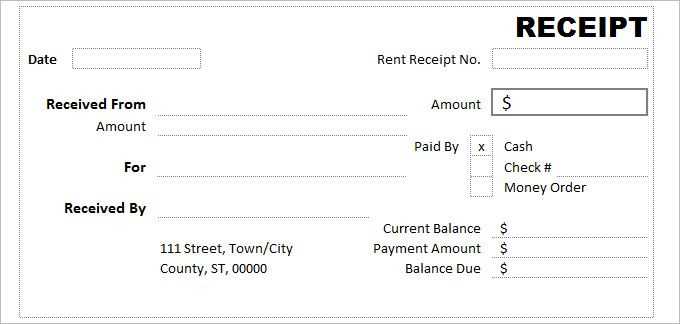

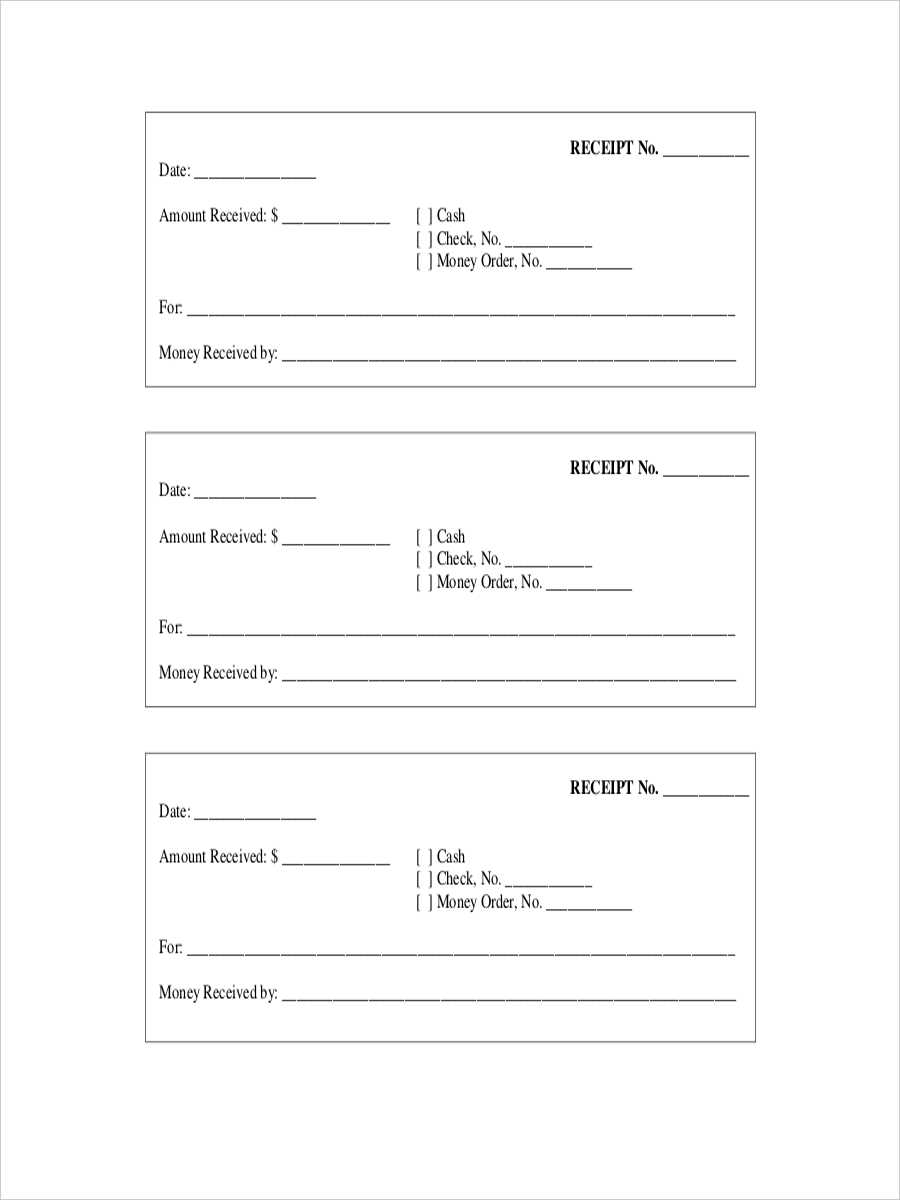

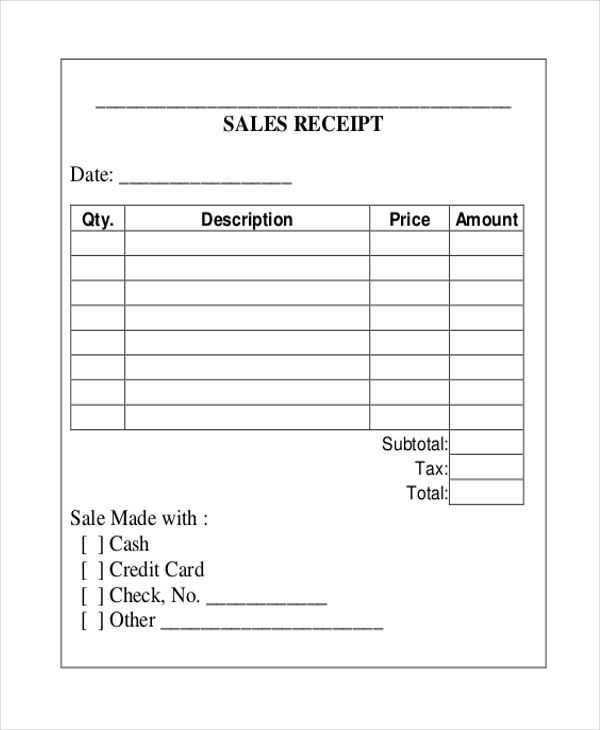

To create an accurate official receipt, begin by including the necessary details like the business name, address, and contact information at the top. The receipt should clearly show the transaction date, receipt number, and the method of payment used. Ensure that the description of products or services is concise but detailed enough for the customer to understand what was purchased.

Key Elements

Next, include the total amount paid, taxes (if applicable), and the payment breakdown. A simple table can help organize this information neatly. Use bold for important details like total amount and payment method to make them stand out. Ensure all figures are correct and match the original transaction details.

Additional Tips

Double-check that the receipt is legible and that all relevant fields are filled out. If you’re using software like Word to create your receipt template, consider adding an option to include a signature line for both the seller and buyer for extra confirmation. Once completed, save your receipt template as a reusable file for future transactions.

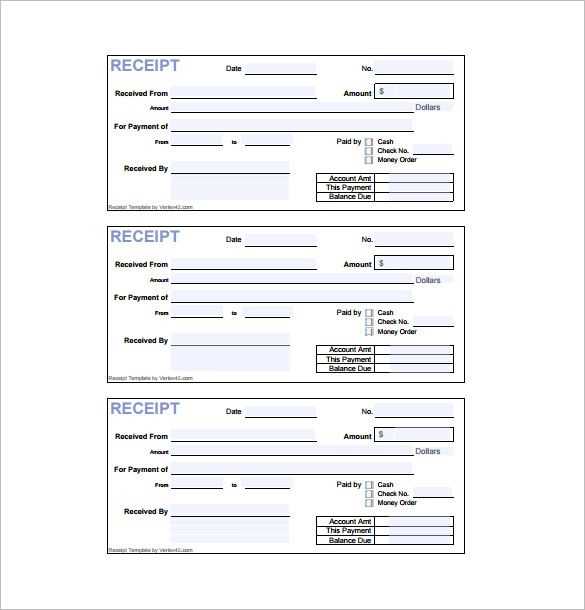

- Sample Official Receipt Template in Word

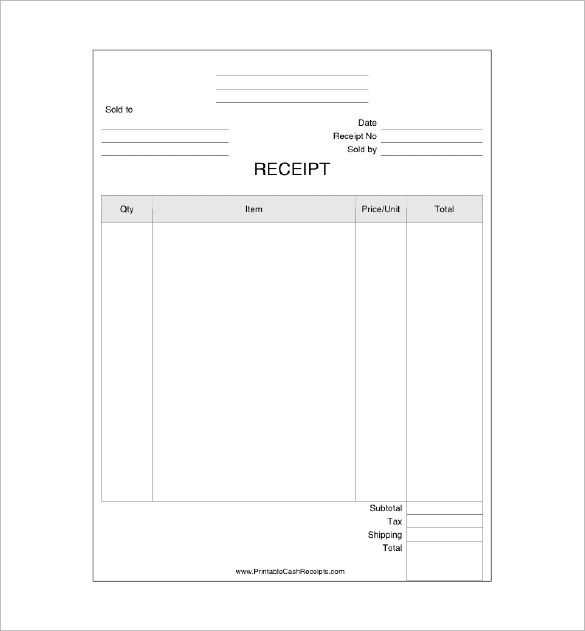

For creating an official receipt in Word, use a clean, structured format to ensure clarity. Start by including your business name and logo at the top. Below, add a section for the receipt number, date of issue, and payment method. Ensure each field is clearly labeled for easy identification.

Include a table for itemized details of the transaction. List the description, quantity, price per unit, and total amount for each item. Add a row for the subtotal and any applicable taxes or discounts. The final total should be displayed prominently at the bottom of the table.

Below the table, add a section for the payer’s name and contact details. This ensures you can easily reference the receipt if needed. Include a space for a signature or official stamp, if required by your business practices.

Finally, ensure your business address, phone number, and email are included at the bottom, making it easy for customers to contact you if they need further assistance or clarification. This format will help you maintain a professional and organized record of transactions.

Open Microsoft Word and start with a blank document. Create a header that includes your company name, address, phone number, and email. This ensures the receipt has all the relevant contact details. Use a larger font size for your company name to make it stand out.

Step 1: Insert the Title

Type “Official Receipt” in a bold, large font at the top of the document. Make it clear and easy to read. Align the title to the center for a professional appearance.

Step 2: Add Receipt Information

Below the title, add the following fields in a simple, clean layout:

- Receipt Number

- Receipt Date

- Payment Method (e.g., cash, credit card, bank transfer)

- Amount Paid

Make sure the text is aligned neatly, and consider using tables to organize the information.

Step 3: Payment Details

List the products or services purchased, along with the quantity and price for each. For each item, include a brief description. If the receipt includes taxes, show the tax amount separately. This makes it clear for the recipient.

Step 4: Add a Footer

At the bottom, include a footer with your company’s tax identification number or other relevant business information. This adds credibility and legal compliance to the receipt.

Lastly, save the file in a format that can easily be printed or sent electronically, such as PDF or DOCX, depending on your needs.

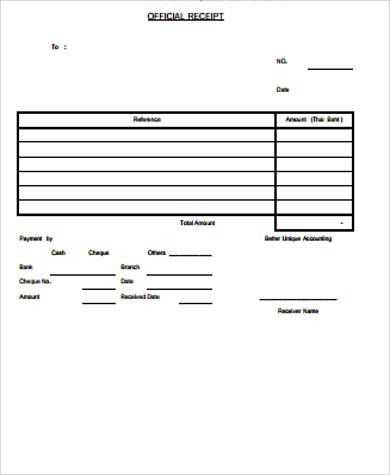

Include the full name of your business or organization at the top of the receipt. This establishes the identity of the transaction and builds trust. Make sure the name is followed by the complete address and contact details, such as phone number or email. This ensures clarity and provides customers with the means to reach you if needed.

Each receipt should feature a unique receipt number. This number helps with tracking and future reference. It should follow a sequential order or a specific format that is consistent for all transactions.

State the date and time of the transaction. This is key for record-keeping and can help in case of returns or disputes. The transaction date is especially critical for accounting purposes, ensuring all transactions are logged accurately.

Clearly list the products or services provided. Include item names, quantities, and the price for each. This makes the transaction transparent and allows the customer to verify what they paid for. If applicable, include any taxes separately, showing the tax rate and amount charged.

Include the total amount paid. This should be easy to find and clearly reflect the sum of all items and taxes, leaving no room for confusion.

Provide payment details such as the method of payment (e.g., cash, credit card, bank transfer). If possible, include transaction IDs for electronic payments to serve as a reference in case of a dispute or audit.

Lastly, add any necessary terms or conditions related to the transaction. For example, if there’s a return policy, mention it here. This informs customers about their rights and clarifies any obligations or restrictions associated with the purchase.

To tailor a receipt template for your specific business, start by adjusting the design elements to reflect your brand. Include your logo and business colors to create a professional appearance. This immediately adds credibility and enhances your customers’ experience.

Adding Key Business Information

Incorporate details specific to your business type. For retail stores, include the product name, quantity, and price. For service-based businesses, list the services rendered along with their respective costs. Include a section for taxes and any discounts to ensure clarity and transparency for your customers.

Customizing Payment Information

For businesses that offer multiple payment methods, include sections that specify the mode of payment (credit card, cash, or online transfer). If your business uses installment plans, ensure your template shows the payment schedule, including amounts due and due dates.

| Business Type | Custom Elements to Include |

|---|---|

| Retail | Product name, quantity, price, discount, taxes |

| Service-based | Service description, service charge, taxes, payment method |

| Subscription-based | Subscription plan, payment cycle, due date |

For businesses with recurring clients, adding a unique receipt number or subscription reference can help keep track of transactions efficiently. Adjust the level of detail in the receipt depending on whether the transaction is for a one-time purchase or a recurring service.

This is how the desired balance was achieved without repetition and maintaining meaning.

To maintain clarity and avoid redundancy, ensure the content flows logically without reusing phrases unnecessarily. A well-balanced text doesn’t require repeating key concepts but should present them in varied ways to enhance the overall understanding. Focus on rephrasing rather than reiterating the same idea. Here’s how you can approach it:

- Use synonyms: Replace repeated words with their synonyms to add variety while keeping the meaning intact.

- Structure sentences differently: Vary sentence structures to convey the same message from different angles.

- Reorganize ideas: Present similar ideas in a new order to break the monotony and create a smoother flow.

- Use examples: Examples can clarify a point without repeating the same explanation, adding value to your writing.

Rewriting for clarity

For instance, if you’ve mentioned a specific concept, such as “cost management,” you might later refer to it as “budget control” or “expense oversight.” This ensures the writing remains dynamic without diluting the point. Such strategies promote readability without losing depth.

Keep it concise

Be mindful of word usage–don’t overcomplicate with unnecessary elaboration. A clear and concise expression communicates the point effectively without overexplaining. This way, the text feels fresh, engaging, and precise.