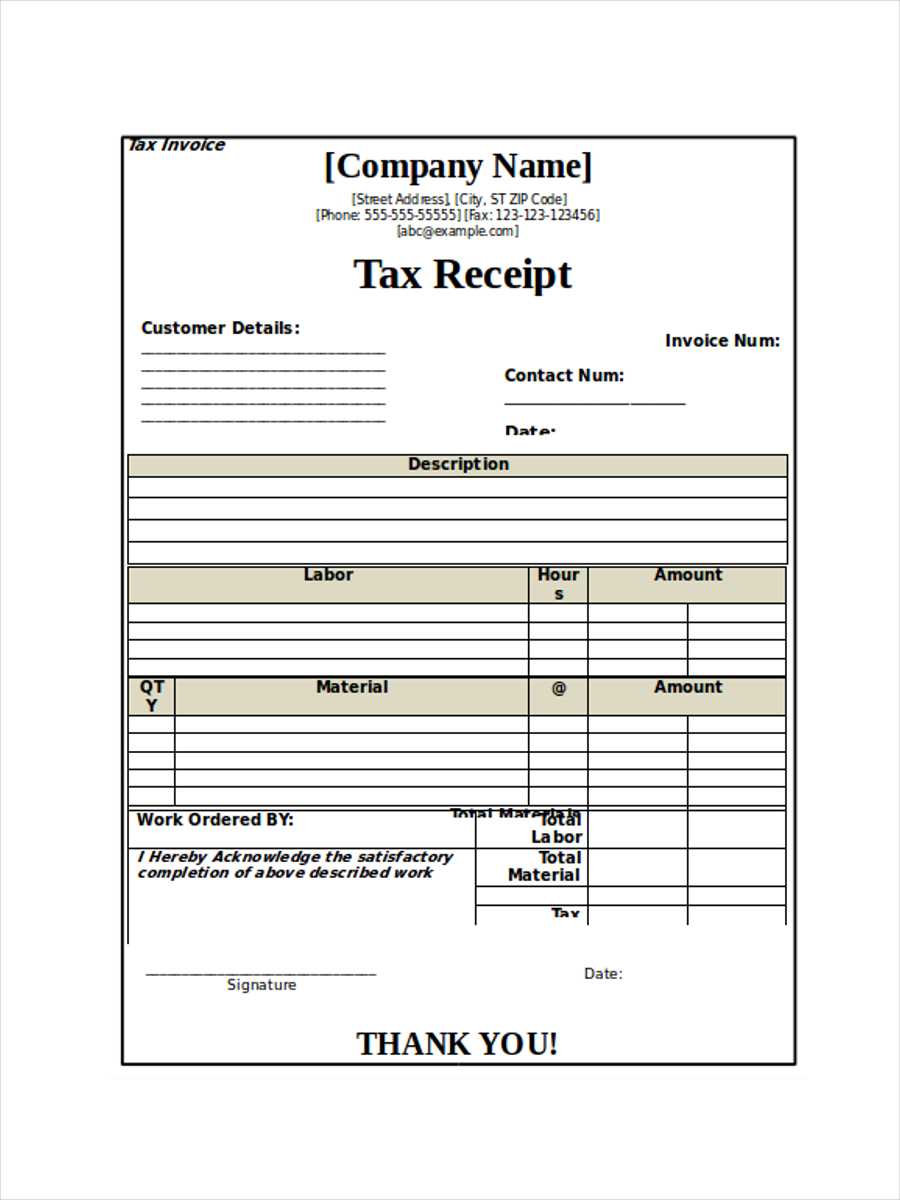

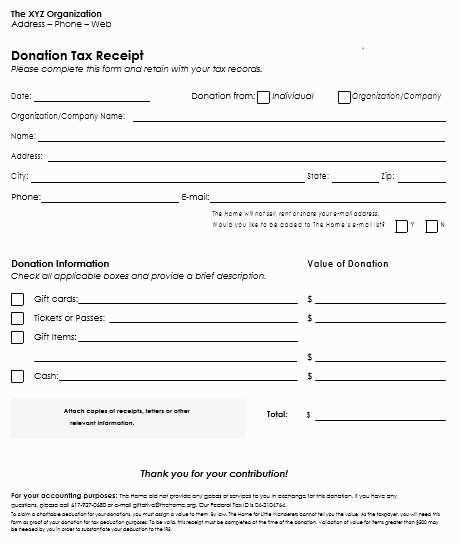

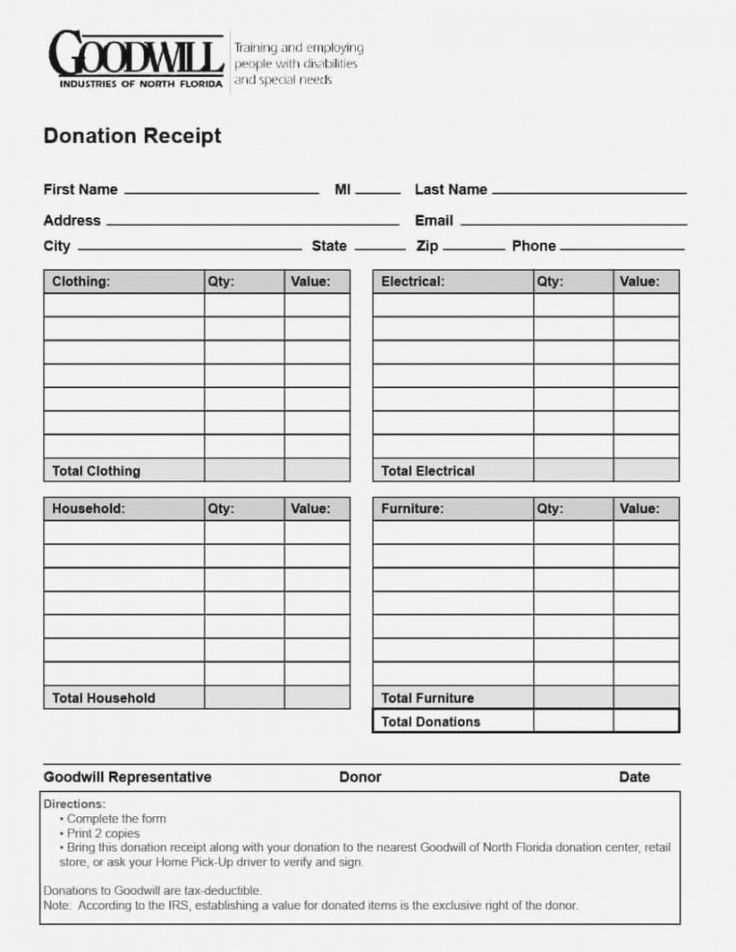

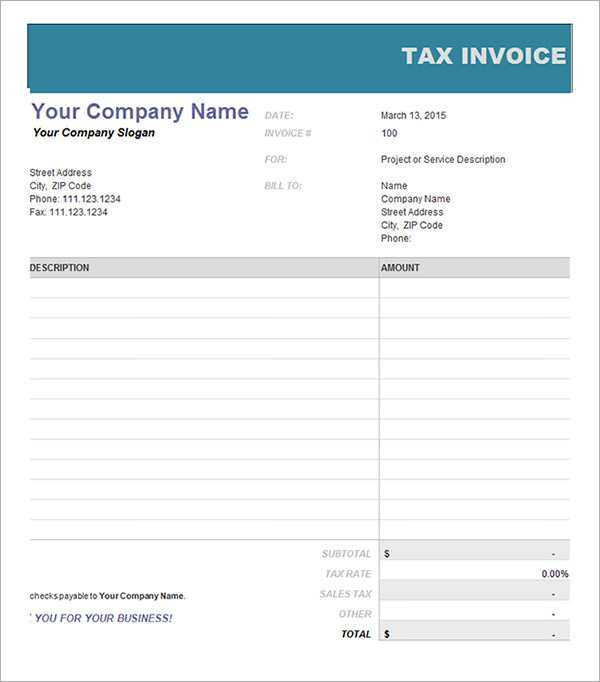

Download and Customize a Ready-Made Template

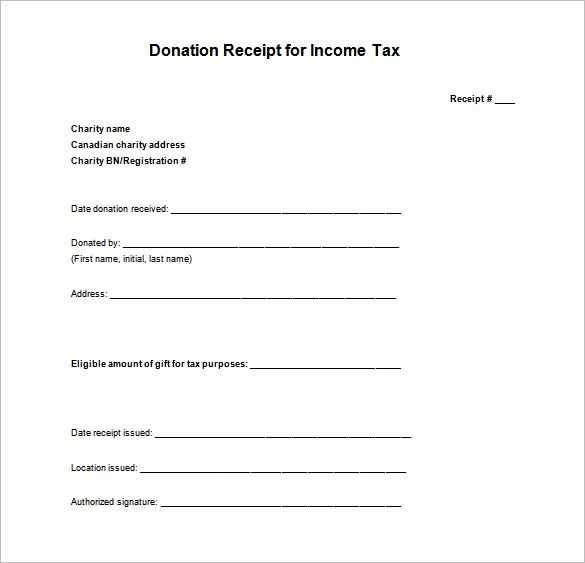

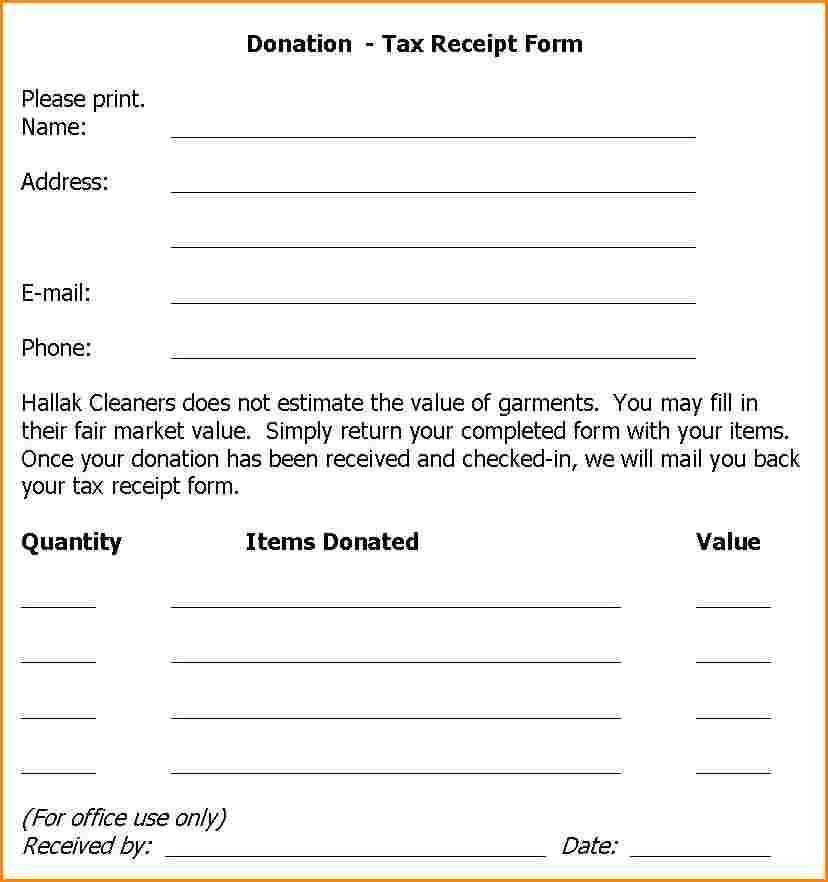

Get a pre-formatted tax receipt template in Word and modify it according to your needs. Ensure all required fields are included, such as payer details, transaction date, and amount paid. Many templates offer placeholders that simplify the process, allowing quick adjustments.

Key Elements to Include

- Business or Individual Name: Clearly state the entity issuing the receipt.

- Contact Information: Include an address, phone number, and email.

- Receipt Number: Use a unique identifier for tracking.

- Payment Details: Mention the amount, method, and date of transaction.

- Purpose of Payment: Specify if it’s a donation, service, or product purchase.

- Signature or Digital Approval: Add an authorized signature or digital confirmation.

How to Format and Save the Document

Adjust fonts, spacing, and alignment to maintain a clean layout. Convert the final version to PDF to prevent modifications. If sending electronically, ensure it is accessible and printable.

Best Practices for Record-Keeping

- Save Digital Copies: Store receipts securely in cloud storage or a local drive.

- Issue Duplicate Receipts: Provide a copy to the recipient and keep one for records.

- Use a Consistent Format: Maintain uniformity for easy reference and auditing.

A well-structured tax receipt ensures compliance and simplifies financial documentation. Using a Word template makes the process faster and more organized.

Tax Receipt Template Word

Key Elements to Include in a Tax Document

How to Format a Receipt in Word

Legal Requirements for Financial Receipts

Customizing a Document for Different Purposes

Saving and Sharing Digital Receipts

Common Mistakes to Avoid When Creating a Financial Record

Ensure every tax receipt includes the payer’s full name, date of transaction, payment method, and itemized details of the transaction. Use a clear title, such as “Official Tax Receipt,” at the top.

When formatting in Word, align text properly using tables for structured layouts. Set font size to at least 10pt for readability and apply bold to critical details like amounts and dates.

Verify compliance with local tax laws by checking required disclosures, such as tax ID numbers and donation disclaimers. Keep a digital copy for records and provide a PDF version to recipients.

For customization, adjust templates based on the purpose. Business receipts may need invoice numbers, while donation receipts should include nonprofit registration details.

To save and share, export the document as a PDF to prevent unauthorized edits. Secure files using password protection when handling sensitive financial data.

Avoid common mistakes such as missing signatures for handwritten receipts, incorrect tax calculations, or vague descriptions that may cause disputes.