For easy VAT management, using a Word template for receipts can save time and streamline your invoicing process. A template ensures all necessary fields are filled in consistently, reducing the chances of mistakes and improving professionalism.

Key Fields to Include

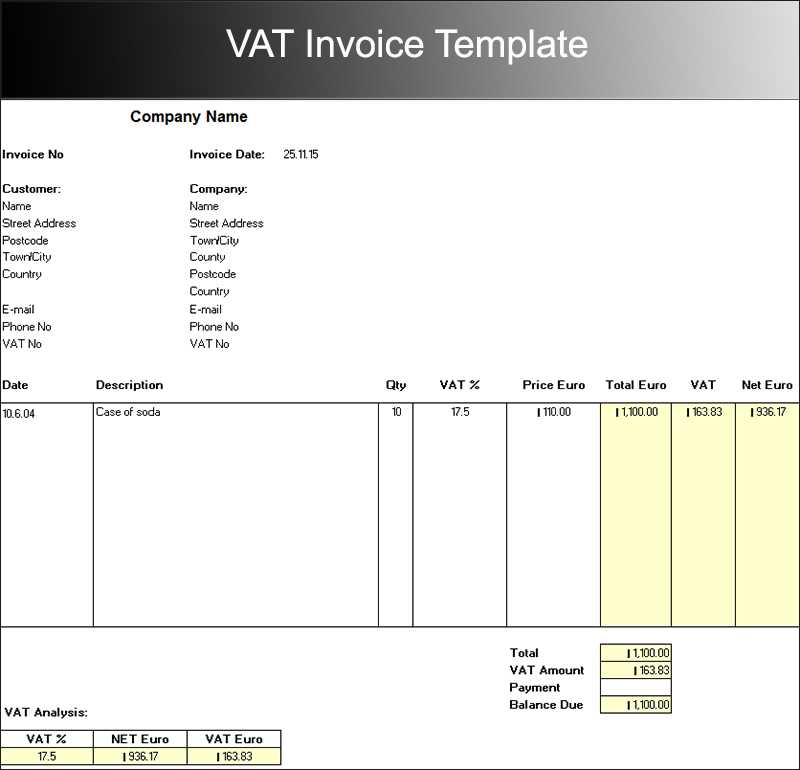

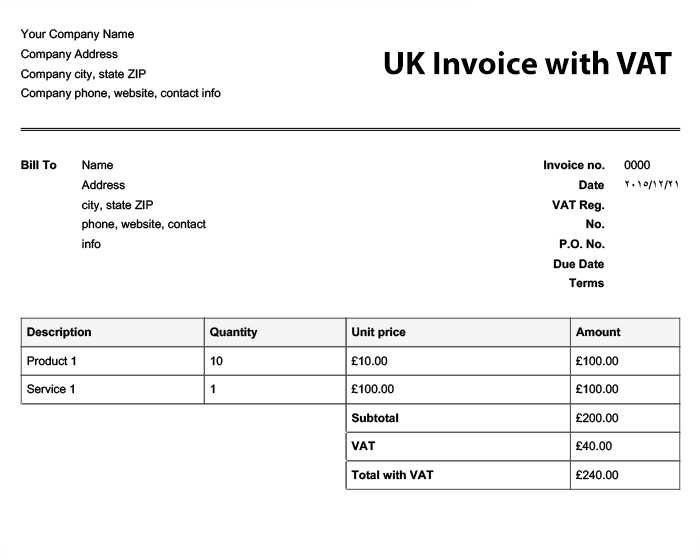

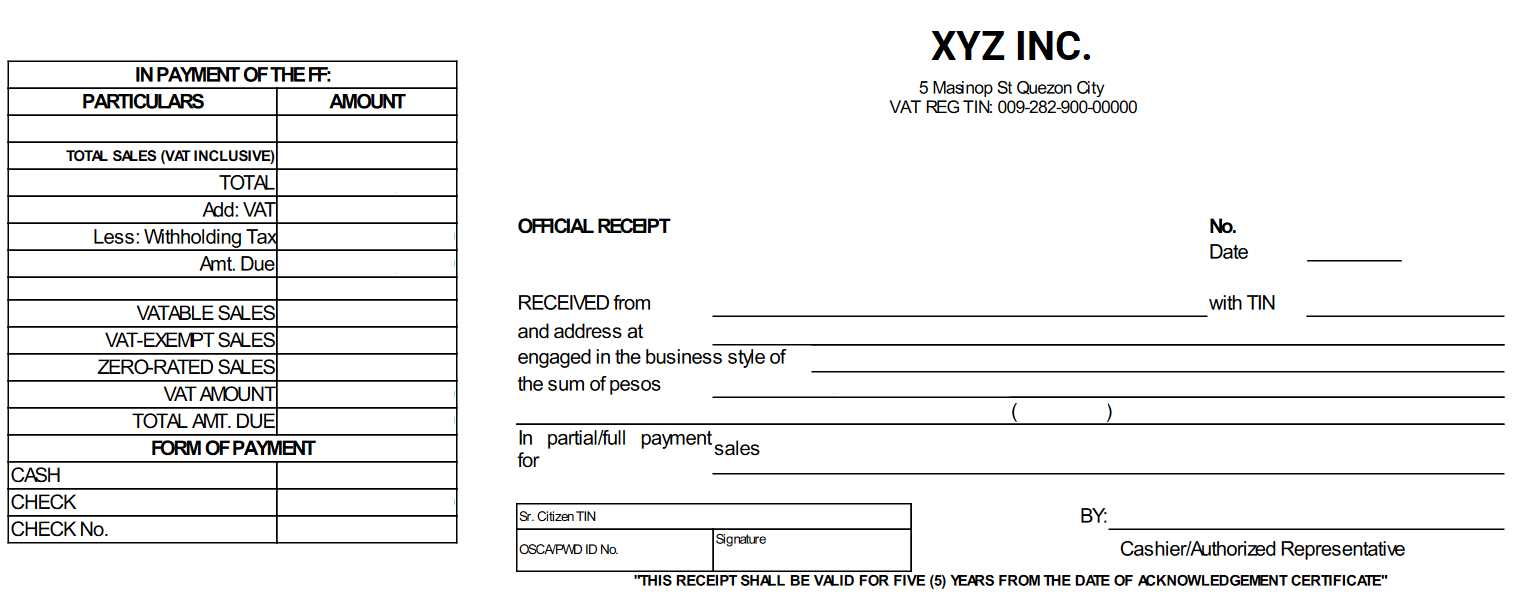

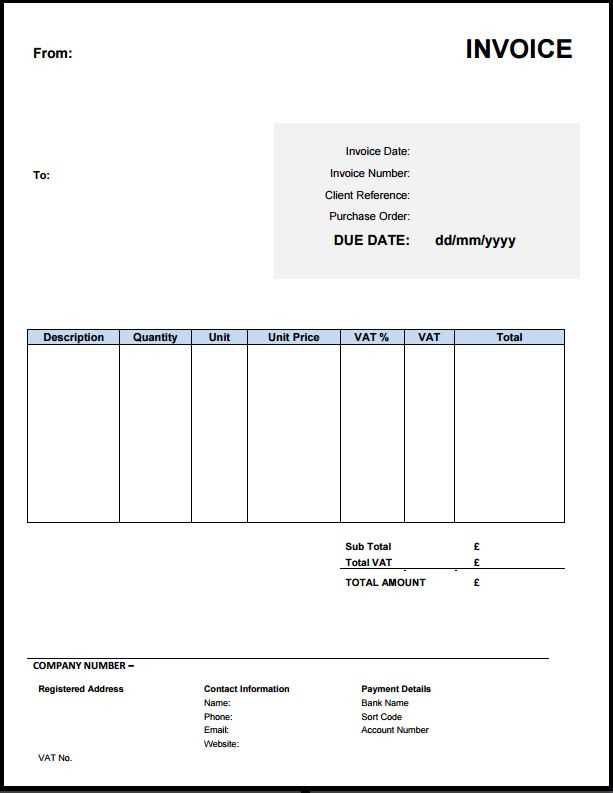

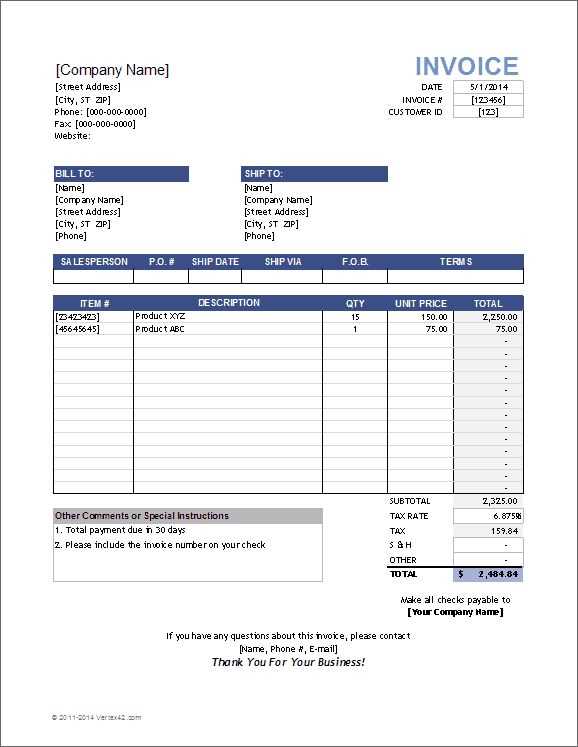

A good VAT receipt template should have the following key fields:

- Receipt Number: A unique identifier for each transaction to avoid confusion.

- Date: Clearly indicate the transaction date.

- Supplier Information: Include the name, address, VAT registration number, and contact details of the supplier.

- Customer Information: Include the customer’s name and address.

- Transaction Details: List the items purchased, their quantities, and individual prices.

- VAT Rate and Amount: Specify the VAT rate applied and the corresponding amount for each item or service.

- Total Amount: Clearly display the total price, including VAT.

Customizing Your Template

While many online platforms offer free VAT receipt templates, you can easily create your own in Word. Start by selecting a simple layout with clean sections. Using tables to align the details in a readable format can improve the presentation.

Consider adding your company logo or branding to make your receipt more professional. Also, ensure that your template includes an area for terms and conditions or any additional information required by local tax authorities.

How to Save and Use the Template

After customizing your template, save it as a Word document (.docx) so you can reuse it for future transactions. Make sure you have an easy way to access and update the template if needed. You can also create a version in PDF format for sending receipts electronically.

VAT Receipt Template in Word: Practical Guide

Creating a Basic VAT Receipt in Word

Customizing for Different VAT Rates

Adding Business Details and Legal Requirements

Formatting for Easy Use

Incorporating Multiple Products and Services in One Receipt

Saving and Reusing Your VAT Receipt

To create a VAT receipt in Word, start by opening a new document and laying out the header section. Include your business name, address, and contact details clearly at the top. Below this, add a title such as “VAT Receipt” or “Tax Invoice” to make it immediately recognizable.

For VAT rates, you can set up different sections for various rates, like standard, reduced, or zero rates. Create a table for product details and break down prices accordingly, ensuring each product or service lists its price before VAT and then the VAT amount based on the applicable rate. Word’s built-in table tools make it easy to organize this data clearly.

Make sure your business information complies with legal requirements, such as including your VAT registration number and the date of issue. It’s also a good practice to list the customer’s details if applicable, like their name or business name, to ensure proper documentation for tax purposes.

Formatting is key for readability. Use simple fonts like Arial or Times New Roman, and avoid overcrowding the page. A clear, professional layout enhances user experience. Ensure each item is well-spaced, and consider using bold or italics for headings or important values like the total amount or VAT rate.

If you’re dealing with multiple products or services in one receipt, adjust your table to include columns for descriptions, quantities, unit prices, VAT rates, and total amounts. This helps both your client and the tax authorities quickly understand the breakdown of each item.

Once you’ve set up your template, save it as a Word document so you can reuse it easily. You can also save it as a template (.dotx) in Word for future use, allowing you to quickly generate new receipts without re-entering common details each time.