Word Donation ReceiptAnswer in chat instead

Word Donation Receipt Template

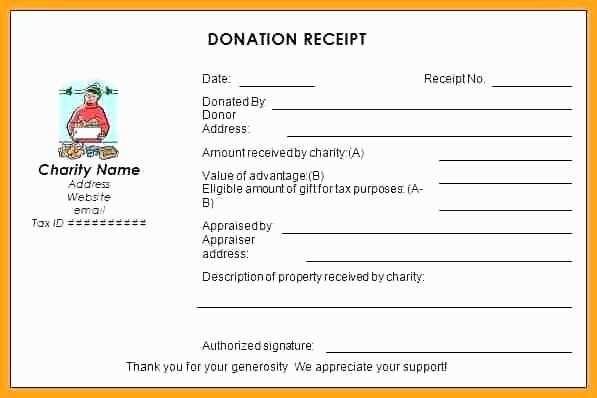

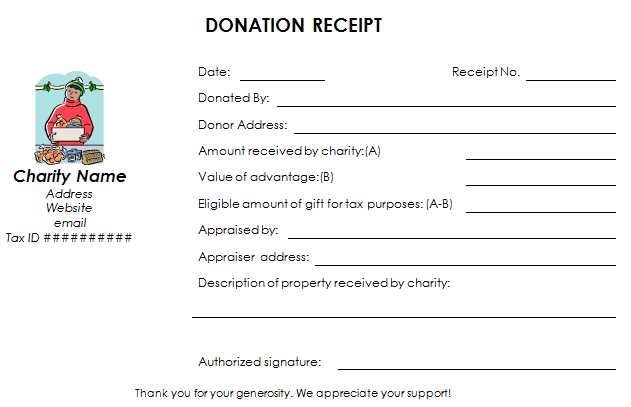

Key Elements to Include in a Donation Receipt

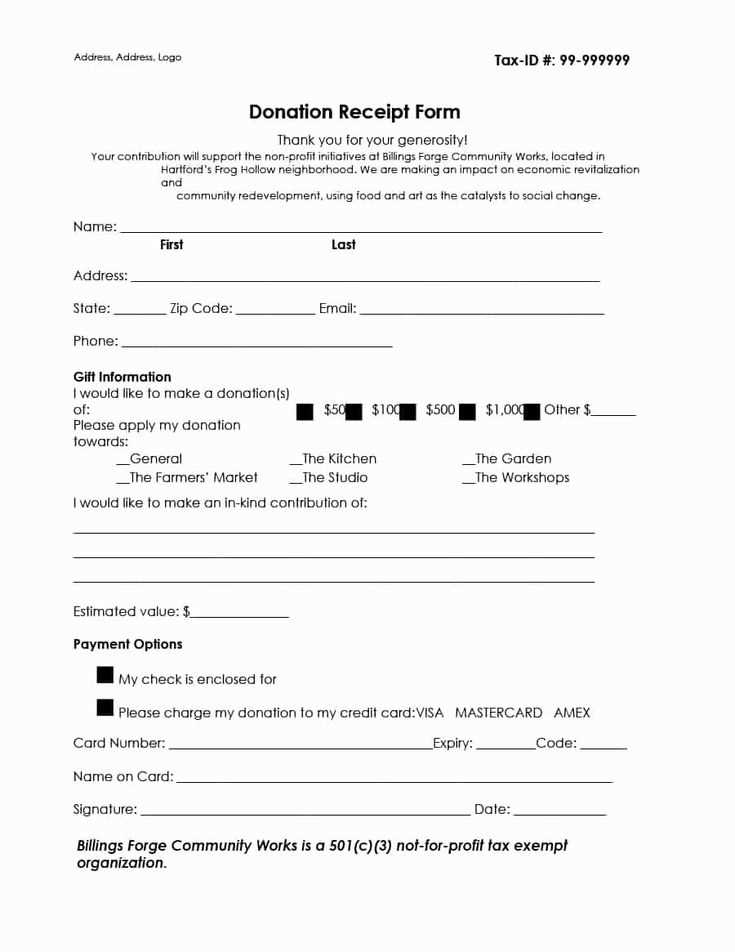

A well-structured donation receipt must contain specific details to ensure its validity for both donors and tax authorities. Include the donor’s full name, organization’s legal name, and date of donation. Clearly specify the amount or description of non-monetary contributions. If applicable, include a statement confirming that no goods or services were provided in exchange for the donation, or describe any benefits received.

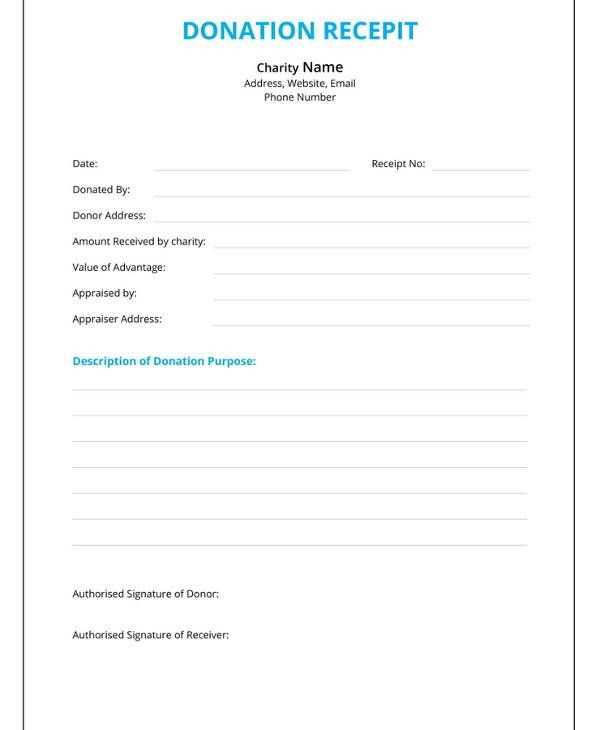

How to Customize a Receipt Template in Microsoft Word

Open Microsoft Word and choose a pre-made receipt template from the template library. If no suitable template is available, create one using a table format. Add placeholders for donor details, donation amount, and tax-exempt status. Use the header section for your organization’s name and logo. Save the document as a reusable template for future receipts.

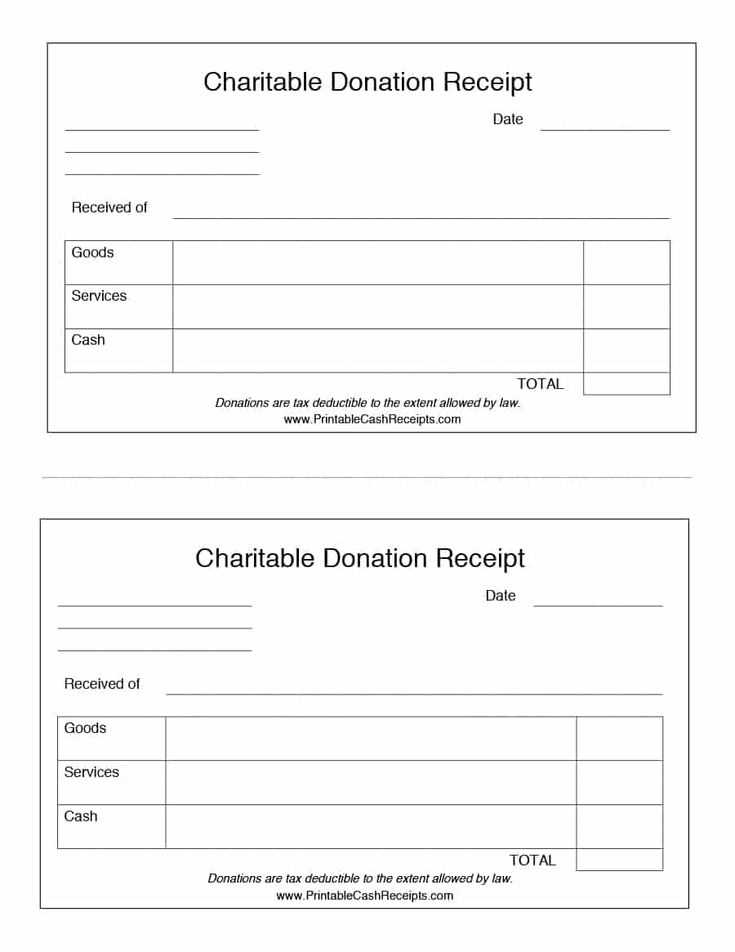

Legal and Tax Considerations When Creating a Receipt

A donation receipt must comply with tax regulations to be valid for deductions. In the U.S., IRS rules require receipts for contributions above $250 to include a written acknowledgment. For non-cash donations, include a description but avoid assigning a value. If your organization provides goods or services in return, specify the fair market value and note the tax-deductible portion.